The Director/Group Head, Investment Banking, Coronation Merchant Bank Limited, Mr Abiodun Sanusi, says the high interest rate regime in Nigeria is limiting banks double digit growth rate.

Explaining industry issues in an interview in Lagos, he said the CBN is saddled with two things, which is the stabilisation of the currency and reduction of interest rate.

According to him, “In stabilising the currency, we need to attract foreign investments. As we speak, there are about $17bn to $20bn of foreign portfolio investments in Nigeria, which is a huge chunk of our reserves. We need to keep that large volume of dollars in Nigeria.

“So, definitely, we need to offer attractive interest rates to investors on a risk-adjusted basis, which is what the CBN is trying to do. Once you have a high interest rate regime at the risk-free level, it affects the entire economy, because the bank price their credit based on what the risk free rate is. If the risk free rate is 15 per cent, we should definitely expect the banks to lend to corporates higher than that because of the credit risk premium they need to get for extending credit to the corporate sector.

“So, that is the reason why it has been challenging for the banks to lend at single-digit or low-digit rate because the CBN provides that direction.

On why the Central Bank of Nigeria initiated the 60 per cent loan-to-deposit ratio, Sanusi averred that “It’s good. If you look at the structure of our economy, you need to do a deep root analysis of the Gross Domestic Product. About 23 to 25 per cent is from agriculture while about 10 per cent is from oil and gas.”

He whereas “the oil and gas that we all think is a major contributor is not contributing as much as people think, telecommunications contributes about eight to 10 per cent; and we have other sectors like the trade and all.”

“Fuel subsidy is also a drag on the economy as we are seeing some sort of most ineffective strategies in that space as there haven’t been a lot of investments in that area. Also, fuel subsidy is a drag because people subsidise production not consumption; so, the government needs to focus on things like this to release more capital for investment in infrastructure.

“Security has also been a challenge as there have been a lot of kidnapping incidents on key trade routes, which have affected economic activities for farmers bringing their produce. The herdsmen and farmers clash has slowed down production across the country.

According to him, “Banks are intermediaries and they would only do what they can do. If you even see the growth of the banks, it is only in single digit as none of the banks has delivered double digit growth rate.”

You may be interested

NPFL: Finidi Satisfied With Rivers United’s Draw Vs Remo Stars

Webby - November 18, 2024Rivers United head coach, Finidi George has expressed satisfaction with his team’s performance in Sunday’s Nigeria Premier Football League (NPFL)…

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

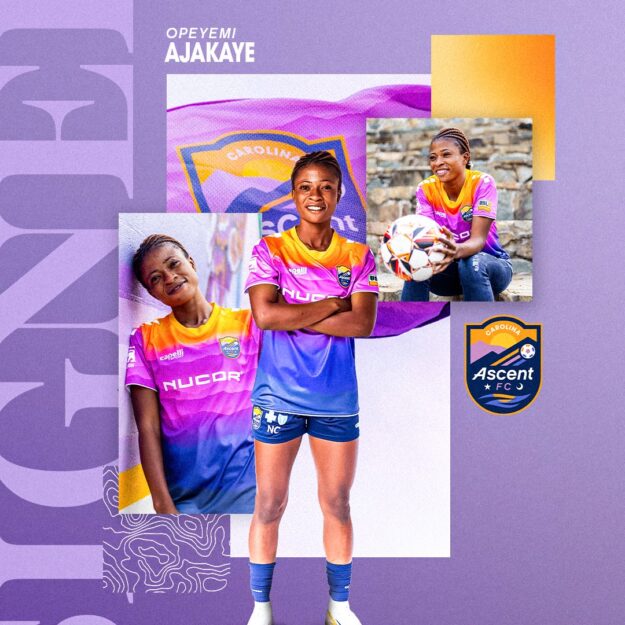

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)