The Central Bank of Nigeria (CBN) has issued a directive prohibiting the use of foreign currency (FCY) as collateral for Naira loans.

This was contained in a circular issued on Monday by Dr. Acting Director of the Banking Supervision Department, Adetona S. Adedeji.

According to the directive, banks are no longer permitted to accept deposits denominated in foreign currencies such as USD, EUR, or GBP as security for Naira loans.

This prohibition extends to most financial instruments based on foreign currency, with exceptions explicitly outlined by the CBN.

Under the new regulation, Nigerian government-issued Eurobonds remain permissible as collateral for Naira loans, along with guarantees from reputable foreign banks, including Standby Letters of Credit.

The directive also providespd a timeframe for banks to address existing loans secured by non-compliant collateral.

The circular reads: “The Central Bank of Nigeria has observed the prevailing situation where bank Customers use Foreign Currency (FCY) as collateral for Naira loans.

“Consequently, the current practice of using foreign currency-denominated collaterals for Naira loans is hereby prohibited, except, where the foreign currency collateral is: Eurobonds issued by the Federal Government of Nigeria; or Guarantees of foreign banks, including Standby Letters of Credit.

“In this regard, all loans currently secured with dollar-denominated collaterals other than as mentioned above should be wound down within 90 days”.

The CBN in the circular also warned of potential consequences for banks failing to comply with the directive.

“Failing which such exposures shall be risk-weighted 150 percent for Capital Adequacy Ratio computation, in addition to other regulatory sanctions,” the apex bank warned.

This adjustment effectively increases the capital reserves required by banks against these loans, impacting their profitability.

While the CBN did not specify the exact nature of additional sanctions, potential penalties could include fines or other punitive measures.

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

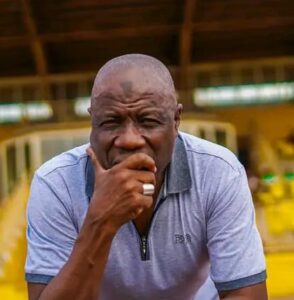

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)