UBA and Zenith Bank have joined Access Corporation as the three biggest banks in the country in terms of total asset base, crossing the N20 trillion mark as of December 2023.

According to their 2023 full year report, Access Bank remains the largest bank in Nigeria with a total asset base of N26.66 trillion, followed by UBA with a total asset base of N20.65 trillion.

Zenith Bank also makes its mark with a total asset of about N20.36 trillion.

According to the banks’ financial statements, UBA recorded the highest total assets growth, surging by a staggering 90.2 per cent from N10.9 trillion in 2022 to N20.7 trillion as of December 2023.

Similarly, Access Corporation experienced significant growth in total assets to reach N26.7 trillion as of 2023 from N14.9 trillion in 2022, marking a 77.9 percent increase.

Zenith Bank total assets grew by 65.8 per cent, reaching N20.4 trillion as of 2023 from N12.4 trillion as of 2022.

UBA also demonstrated impressive growth, with its PAT reaching N607 billion, marking a substantial 257 per cent YoY increase. Additionally, Zenith Bank achieved its highest-ever PAT of N679.9 billion, showcasing a remarkable 202.3 per cent YoY growth.

READ ALSO: Access Holdings in strategic alliance with Coronation Group, 2 others to broaden Remittances

The growth recorded by the three banks was largely influenced by the massive gains in forex revaluations as well as income from fx derivatives.

The collective ascent of Access Bank, UBA, and Zenith Bank to the N20 trillion asset base highlights a broader trend of sustained growth in financial strength within Nigeria’s banking sector in the last 20 years.

In addition, with great size comes great responsibility, especially with the recapitalization raise requirement.

These banks now bear a more significant role in propelling sustainable banking practices, fostering financial inclusion, perpetuating improvements in Corporate Governance standards, and contributing to the economic development of Nigeria and Africa as a whole.

For customers, the size of a bank’s assets can be reassuring, indicating the institution’s capacity to safeguard deposits and meet withdrawal demands.

For investors, it signals the bank’s growth prospects and financial health, often translating into confidence in the bank’s stock.

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

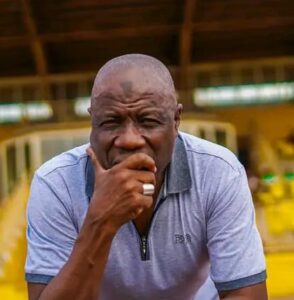

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)