On Friday, the Central Bank of Nigeria revoked the licenses of 4,173 Bureau De Change operators due to their failure to comply with regulatory guidelines.

The apex bank disclosed this in a statement by its acting Director, Corporate Communications, Sidi Hakama.

This means there will now be 1,517 operational BDCs from the initial 5,690.

However, the President, Association of Bureau De Change of Nigeria, Aminu Gwadabe, when contacted for comments on the development, told one of our correspondents that he wanted to pray at some minutes before 8pm.

Subsequent calls to his line were not taken.

In the CBN statement, Hakama said the licence withdrawal was in exercise of the powers conferred on the apex bank by the Bank and Other Financial Institutions Act, 2020, Act No. 5, and the Revised Operational Guidelines for Bureaux De Change, 2015.

The statement read in part, “The Central Bank of Nigeria, in the exercise of the powers conferred on it under the Bank and Other Financial Institutions Act, 2020, Act No. 5, and the Revised Operational Guidelines for Bureaux De Change, 2015, has revoked the licences of 4,173 Bureaux De Change Operators.

“The list of affected BDC operators is available on the Bank’s website (www.cbn.gov.ng).”

It added that the affected institutions failed to observe at least one of the regulatory provisions.

According to the statement, the regulatory provisions include payment of all necessary fees, including licence renewal, within the stipulated period.

It added, “The affected institutions failed to observe at least one of the following regulatory provisions: Payment of all necessary fees, including licence renewal, within the stipulated period in line with the guidelines.

“Rendition of returns in line with the guidelines; compliance with guidelines, directives, and circulars of the CBN, particularly Anti-Money Laundering, Countering the Financing of Terrorism and Counter-Proliferation Financing regulations.

“The CBN is revising the regulatory and supervisory guidelines for Bureau de Change operations in Nigeria. Compliance with the new requirements will be mandatory for all stakeholders in the sector when the revised guidelines become effective.

“Members of the public are hereby advised to take note and be guided accordingly.”

Recall that the CBN had recently introduced a draft guideline for BDC operations across the country.

Major provisions introduced in the guidelines include the introduction of N2bn minimum share capital for Tier-1 BDCs, limiting buying and selling of forex in cash by BDCs to $500, and $10,000-year limit for school fees, among others.

Reacting to the development, the Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, applauded the move to regulate the operations of the BDCs.

He said, “Definitely, revoking the licences of non-operational BDCs is the appropriate thing to do now. It is the right move because the previous number was difficult to manage and unwieldy.”

You may be interested

UECLQ: Uzoho Benched In Omonia Nicosia Home Win

Webby - July 25, 2024Francis Uzoho was not in action for Omonia Nicosia as he was benched in their 3-1 win against Torpedo Kutaisi…

Paris Olympic Women’s Football: Super Falcons Will Bounce Back To Winning Ways Against Spain –Agu

Webby - July 25, 2024Former Nigerian international Alloy Agu says he’s optimistic the Super Falcons will bounce back to winning ways against Spain in…

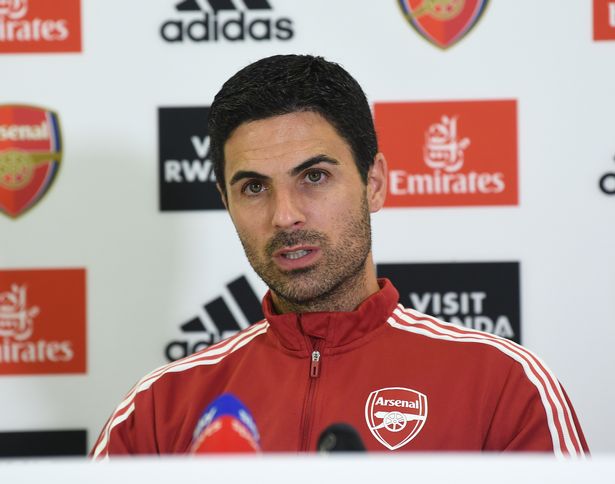

Arsenal Linked With Big Money Move To Sign Striker Jose Mourinho Likens To Didier Drogba

Webby - July 25, 2024Arsenal’s move to bring in a proven finisher has apparently led them to Naples, with Gunners boss Mikel Arteta reportedly…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)