*Sustains N3.6trn proposed by executive

*Pushes Oil Price benchmark from $70 to $73 per barrel

*With projected Inflation rate of 17.16%

By Henry Umoru, Abuja

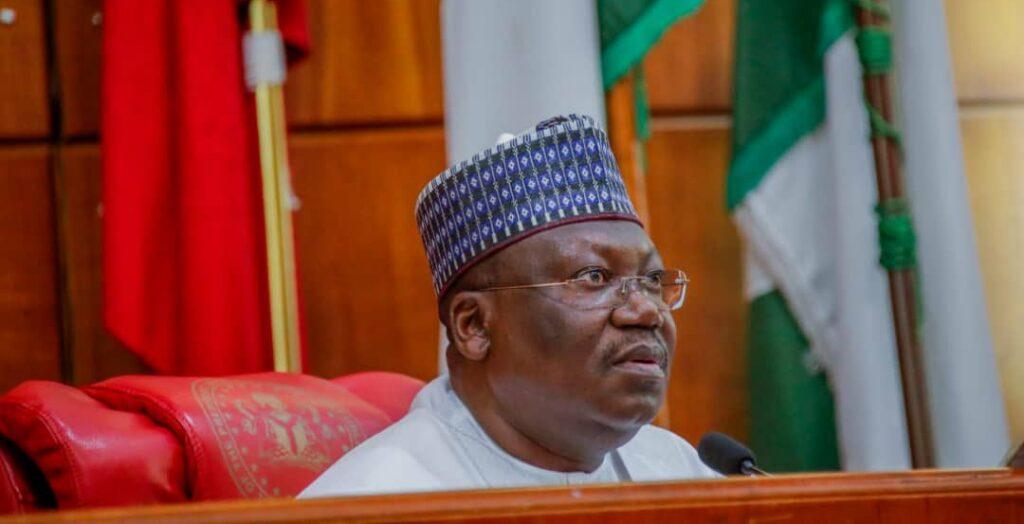

THE Senate, yesterday, passed the 2023-2025 Medium Term Expenditure Frame Work and Fiscal Strategy Paper, MTEF /FSP.

The approval was sequel to the consideration of the Senator Olamilekan Adeola, All Progressives Congress, APC, Lagos West-led Senate Committee on Finance.

Read Also: How petrol subsidy raised 2022 borrowing by N1trn – DMO boss

Senators were, however, divided over one of the recommendations of the committee that suggested that the cost of subsidy be capped at N1.7. Trillion, which is less than the N3.6 Trillion initially proposed by the executive.

During the consideration of the report, the Senate kicked against move by its Committee on Finance to reduce N3.6trllion proposed for subsidy in the 2023 budget by the executive to N1.7trillion.

President Muhammadu Buhari had in the 2023 – 2025 MTEF /FSP proposed N3.6trillion for fuel subsidy from January to June in 2023, just as the Senate Committee in its report on the proposals presented for consideration by the Senate, recommended N1.7trillion for fuel subsidy for the entire 2023 which was however rejected by sustaining the earlier proposed N3.6trillion earmarked for subsidy.

The committee’s recommendation for $73 per barrel oil price benchmark for the proposed N19.76 2023 budget was, however, approved against $70 per barrel proposed by the executive in the MTEF/FSP documents.

According to the Senate, the daily crude oil production of 1.69mbpd, 1.83mbpd, and 1.83mbpd for 2023, 2024 and 2025 respectively, be approved and that the oil price of $73 per barrel of crude oil be approved as a result of continuous increase in the oil price in the global oil market and other peculiar situations such as continuous invasion of Ukraine by Russia as this will result in saving of N155 billion.

The Senate said the exchange rate of N437.57 be sustained as contained in the MTEF FSP document with continuous engagement between the Central Bank of Nigeria and Federal Ministry of Finance, Budget and National Planning with the view of bridging the gap between the official market and parallel market.

In his presentation, Senator Adeola explained that scenario 2 of the 2023 budget proposed by the executive in the MTEF / FSP document , was adopted by the committee because of lesser vote for budget deficit and over N1trillion for capital votes for the various Ministries , Departments and Agencies ( MDAs) .

The scenario two has a proposed total expenditure profile of N19.76trillion and deficit of N11.30trillion, against scenario one which has a proposed total expenditure profile of N18.75 trillion, with deficit of N12.41trillion and zero allocation for capital projects for the MDAs.

Scenario two recommended by the committee for approval by the Senate and accordingly approved is based on other critical parameters such as1.69million barrel oil production per day, N437.57k exchange rate to a US dollar and 3.75% Gross Domestic Product, GDP, growth rate.

Others are projected inflation rate of 17.16% and new borrowings of N8.437trillion , N6.31trillion for Debt Service, N722.11billion as statutory transfers etc .

The report said: “A retained revenue of N9.352 trillion as result of increase in the benchmark as the ceiling oil subsidy to the year in review; Fiscal deficit of N11.3 trillion (including GOEs);

“New Borrowings of N8.437trillion (including Foreign and domestic Borrowing), subject to the provision of details of the borrowing plan to the National Assembly; Statutory transfers, totaling, N722.11 billion; Debt Service estimate of N6.31 trillion; Sinking Fund to the tune of N247.7 billion;

“Pension, Gratuities & Retirees Benefits of N827.8 billion; and Aggregate FGN Expenditure of N19.76 trillion; made up of Total Recurrent (Non-debt) of N8.53 trillion; Personnel Costs (MDAs) of N827.8 billion; of Capital expenditure (exclusive of Transfers) N3.96 trillion; Special Intervention (Recurrent) amounting to N350 billion; and Special intervention (Capital) of N7 billion.”

The Senate approved the recommendation on exiting of 10 out of the 63 Government Owned Enterprises ( GOEs). The affected GOEs are the Nigerian Communication Commission ( NCC) , Corporate Affairs Commission ( CAC) , Nigeria Port Authority ( NPA) , Joint Admission and Matriculation Board ( JAMB) and Nigerian Maritime Administration and Safety Agency ( NIMASA) .

Others are the Federal Inland Revenue Service ( FIRS), Nigeria Customs Service ( NCS) , National Agency for Food and Drug Administration and Control (NAFDAC) , Nigeria Upstream Petroleum Regulatory Commission ( NUPRC) and Nigerian Midstream and Downstream Petroleum Regulatory Agency (NMPDRA).

Subscribe for latest Videos

You may be interested

WAFU B U-17 Girls Cup: Ghana Edge Gallant Flamingos On Penalties In Final

Webby - December 22, 2024Despite a spirited performance Nigeria’s Flamingos lost on penalties to hosts Ghana on penalty shootout in the final of the…

Bournemouth Equal Burnley’s Old Trafford Feat After 3-0 Win Vs United

Webby - December 22, 2024Bournemouth’s 3-0 win against Manchester United on Sunday meant the Cherries equaled Burnley’s feat at Old Trafford.United went into the…

Vitolo Announces Retirement From Football

Webby - December 22, 2024Former Spain forward Vitolo has announced his retirement from football.The former Atletico Madrid, Las Palmas and Sevilla confirmed his retirement…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)