The Central Bank of Nigeria (CBN) has directed all deposit money banks in the country to restructure loan terms and tenors to households and businesses affected by the coronavirus outbreak.

Addressing journalists in Abuja on Monday, Godwin Emefiele, the CBN governor, said the interest rate of its intervention programmes has been cut to 5% from 9%.

“The CBN hereby grants all deposit money banks leave to consider temporary and time-limited restructuring of the tenor and loan terms for businesses and households most affected by the outbreak of Covid-19 particularly oil & gas, agriculture, and manufacturing,” he said.

“The CBN would work closely with DMBs to ensure that the use of this forbearance is targeted, transparent and temporary, whilst maintaining individual DMB’s financial strength and overall financial stability of the system.”

The CBN said beneficiaries of its intervention facilities have been granted an additional one-year moratorium on principal repayments effective March 1, 2020.

“This means that any intervention loan currently under moratorium is hereby granted an additional period of one year.”

“Interest rates on all applicable CBN intervention facilities are hereby reduced from 9 to 5% per annum for 1 year effective March 1, 2020.”

The apex bank said it has created a N50 billion credit facility for small and medium-sized businesses that have been affected by the coronavirus outbreak.

“The CBN hereby establishes a facility through the NIRSAL Microfinance Bank for households and small- and medium-sized enterprises (SMEs) that have been particularly hard hit by Covid-19, including but not limited to hoteliers, airline service providers, health care merchants, etc.”

It has also extended intervention facilities and loans to pharmaceutical companies ” intending to expand/open their drug manufacturing plants in Nigeria, as well as to hospital and healthcare practitioners who intend to expand/build the health facilities to first-class centres”.

This is the first action the central bank is taking in response to the coronavirus outbreak that began in China in December.

You may be interested

NPFL: Finidi Satisfied With Rivers United’s Draw Vs Remo Stars

Webby - November 18, 2024Rivers United head coach, Finidi George has expressed satisfaction with his team’s performance in Sunday’s Nigeria Premier Football League (NPFL)…

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

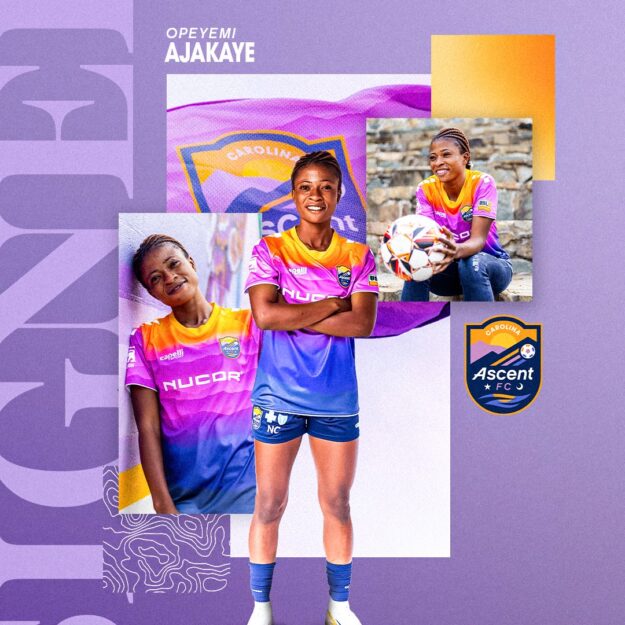

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)