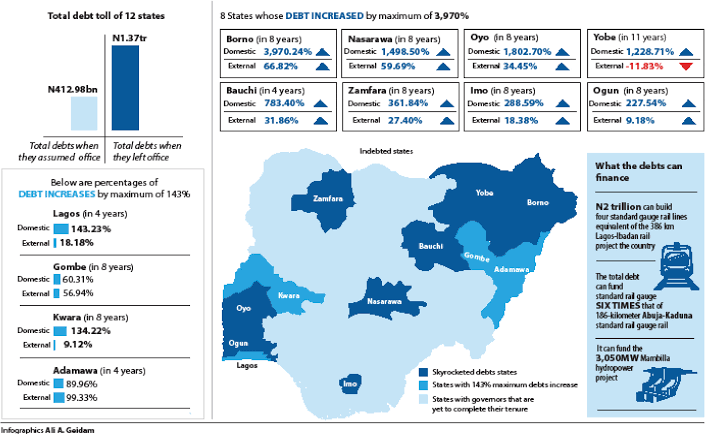

Twelve states where there was a change of government recently are reeling under heavy debt burden amounting to over N2tr, Daily Trust investigations have shown.

Analysis of official data from Debt Management Office (DMO), National Bureau of Statistics (NBS), and various reports of transitional committees revealed that the debt increased under the immediate past governments in the states.

Findings made available to reporters revealed that some of the debts were not captured in the DMO and NBS official data, suggesting the figure may be more.

For instance, the DMO data did not include debts incurred using local contractors, suppliers, and consultants. DMO data only covered debts incurred by states through official borrowings such as multilateral and bilateral foreign and local financial institutions, investment securities like bonds and treasury bills.

These debts rose despite a series of billions channeled to the states by the federal government as federal allocations (FAAC), bailouts, Paris fund refunds, among others.

Former Governors Akinwunmi Ambode (Lagos), Kashim Shettima (Borno), Rochas Okorocha (Imo), and nine others increased their states’ domestic debt stock by over 200 percent from N412.98bn as at when they assumed office to N1.37tr as at when they left the office.

During the same period, the 12 governors combined increased their states’ external debt stock by 81 percent from $1.75bn as at the inception of their tenures to $2.16bn as at when they vacated their offices.

The 12 states combined also recorded total Internally Generated revenues (IGRs) of N1.14tr during the period.

The other ex-governors included Abdulaziz Yari (Zamfara), Ibrahim Gaidam (Yobe), Mohammed Abubakar (Bauchi), and Ibrahim Dankwambo (Gombe), Muhammadu Bindow (Adamawa), Umaru Al-Makura (Nasarawa), Ibikunle Amosun (Ogun), Abiola Ajimobi (Oyo), and Abdulfatah Ahmed (Kwara).

The governors borrowing increased their states’ domestic debt stock by over 200 percent and their foreign debt stock by over 81 percent. While Ambode, Abubakar, and Bindow spent four years in office each, the rest spent eight years, except Gaidam, who spent 10 years. N612bn debt left by Yari, Dankwambo, Ajimobi, Bindow For instance, four former governors Yari, Dakwambo, Bindow, Abubakar, and Ajimobi have left behind over N612bn debts, according to reports of transition committees.

The Zamfara State transition committee said Yari has left behind a debt of N251bn – an amount he denied without giving the actual figures he left. Dankwabo left behind debts of N110bn, while Bindow and Abubakar left N115bn and N136bn respectively. Oyo State Governor Seyi Makinde announced last week that his predecessor, Ajimobi had left behind over N150bn debt. These debts profile released by the transition committees is far above what Daily Trust obtained from the official websites of DMO and NBS.

Data from DMO revealed that Zamfara’s domestic debt stock grew to N59.90bn as at December 31, 2018, from the N12.97bn recorded as at December 31, 2011, when Yari took over. The external debt stock also rose to $33.52m from $26.31m during the same period. Zamfara recorded a total IGR of N32.23bn from 2011 to 2018, shortly before the Yari vacated office. The state also got N188.5bn as federal allocations, between 2013 and 2017. The domestic debt stock of Bauchi State grew to N92.37bn as at December 31, 2018, from the N57.62bn recorded as at December 31, 2015, after Abubakar assumed office as governor.

Bauchi’s external debt stock also rose to $133.93m to $85.34m during the same period. Data from NBS showed that Bauchi State’s IGR from 2015 to 2018 stood at N28.13bn, rising from N5.39bn in 2015 to N8.68bn in 2016 and down to N4.37bn in 2017 and up to N9.69bn in 2018. Bauchi also received N234.9bn as federal allocations between 2013 and 2017. Gombe State also witnessed a rise in domestic debt to N63.34bn as at December 31, 2018, to N7.17bn as at December 31, 2011, while its external debt stock rose to $37.41m from the $28.37m recorded during the same period. Gombe’s IGR from 2011 to 2018 stood at N36.27bn, about double the size of the states’ domestic stock when the governor vacated office.

From 2013 to 2017, the state got N172.1bn as FAAC. Adamawa State State’s domestic debt stock rose to N89.66bn as at December 31, 2018, from N47.20bn as at December 31, 2015, after the governor assumed office. The external debt stock also rose from $97.79m as of December 31, 2018, from $49.06m recorded as of December 31, 2015. The state also recorded a total IGR of N22.64bn from 2015 to the end of 2018, being the last four years under review. Between 2013 and 2017, N213.7bn accrued to Adamawa as federal allocation.

The reports of transition committees were mostly made public in states where different parties took over from the outgoing governors. Yari, Dankwambo, Abubakar, and Bindow handed over to governors from the opposition parties. Rising debt burden Data sourced from DMO show that Lagos States’ domestic debt stock rose to N530.24bn as at December 31, 2018, shortly before Ambode left office from N218bn the 218.54bn recorded as at December 31, 2015, shortly after he assumed office.

Lagos State’s foreign debt stock also rose to $1.43bn from $1.21bn during the same period under Ambode. Within the same period, data from the NBS said Lagos State generated N1.29tr as IGR. In 2015, the state generated N268.2bn, N302.4bn in 2016, N333.9bn in 2017 and N382.18bn in 2018. Lagos got N479.1bn as federal allocations between 2013 and 2017. Yobe State’s domestic debt stock increased to N27.77bn as at December 31, 2018, from the N2.09bn recorded as at December 31, 2011, while the state’s externals debt stock reduced to $27.49m from N$31.18m within the same period.

Yobe State recorded a total IGR of N23.94bn from 2011 to the end of 2018, shortly before the governor vacated the office. The state received a total of N216.7bn as federal allocations from 2013 to 2017. While Borno State recorded a total IGR of N27.32bn in the last eight years, the state’s domestic debt stock rose to N68.38bn from the N1.68bn recorded as at December 31, 2011, while its external debt also to $21.62m from $12.96m in the same period. Borno got N263.2bn FAAC allocations from 2103 to 2017. In Imo State, domestic debt rose to N98.78bn at December 31, 2018, from N25.42bn recorded as at December 31, 2011, while external debt rose to $59.52m from $50.28m during the same period. Imo State’s IGR from 2011 to 2018 stood at N61.32bn, being N37.46bn short of the total domestic stock the governor bequeathed to the state after he vacated office. Imo’s FAAC allocation between 2013 and 2017 is N226.4bn.

Nasarawa State saw a rise in domestic debt stock to N85.36bn as at December 31, 2018, from the N5.34bn recorded as at December 31, 2011, while the state’s external debt stock also rose to $59.18m from $37.06m during the same period. Nasarawa State earned a total of N96.05bn as IGRs from 2011 to 2018, slightly higher than the state’s total debt stock as at the end of 2018. It also received N186.2bn as FAAC between 2013 and 2017.

The domestic debt stock of Ogun, Oyo and Kwara States rose to N98.72bn, N91.52bn and N59.14bn respectively as at December 31, 2018, from N30.14bn, N4.81bn and N25.25bn respectively. During the same period, the external debts of Ogun, Oyo and Kwara States also rose to $103.26m, $104.99m and $48m respectively from $94.58m, $78.09m and $43.99m respectively. The total IGRs of Ogun, Oyo and Kwara States stood at N562.86bn, N136.75bn and N113.55bn from 2011 to 2018. ‘Debts are lifetime burden for states’

Most of these debts were incurred to fund salaries and overheads and therefore, become lifetime burden on the states, Dr Aminu Usman, of the Department of Economics at the Kaduna State University, said. “When you borrow to finance fiscal operations of the government, then it becomes a lifetime burden on the state. That is exactly what we do,” he said. Dr Usman said another major problem of the debt is that the lenders do not tie the funds to specific projects and even when tied to projects, the lenders do not monitor to ensure that the funds are used specifically to the projects. He added that external debts are bad for states due to exchange rates instability and states not earning enough foreign currencies. Auwal Musa Rafsanjani, executive director of the Civil Society Legislative Advocacy Centre (CISLAC), a governance tracking organisation, blamed the “state governors’ frivolous and irresponsible borrowing” on “poor legislative oversight of state assemblies.”

He said most of the debts accumulated by states over the years have been siphoned in the guise of project implementation, jumbo allowances for ex-public office holders and corruption in general. What the debt can finance If the N2tr debt profile is to be used for the rail project, the money will be enough to build four standard gauge rail lines across the country, the equivalent of the 386km Lagos –Ibadan modern rail project, which is being built at the cost of N568bn ($1.58bn.) The debt is also enough to construct another standard rail gauge six-times that of 186-kilometer Abuja -Kaduna, constructed at N314.6bn ($874m). The total debt stock can also fund the 3,050MW Mambilla hydropower project, which includes the construction of four dams and 700 kilometres of transmission lines, awarded by the federal government at the cost of $5.792bn (N2.085tr) to a Chinese consortium.

What states can do over debts – Experts

On the way out of the debt debacle, Dr Usman said “I think any serious governor should not have a retinue of too many aides. Even if it makes political sense, it does not make financial sense because the cost will be overbearing,” he said. He said states need to harness their potentials in IGRs by overcoming the usual political considerations on policies bordering on increasing IGRs. “States need to actually put emphasis on internally generated revenues vigorous.

They need to cut a lot of wastes in the way of project implementation, especially the cost of contracts,” he said. On his part, the CISLAC chief said there is a need for laws to restrict borrowings that are unjustifiable, not tied to capital projects and have no direct impact on human development.

You may be interested

NPFL: Finidi Satisfied With Rivers United’s Draw Vs Remo Stars

Webby - November 18, 2024Rivers United head coach, Finidi George has expressed satisfaction with his team’s performance in Sunday’s Nigeria Premier Football League (NPFL)…

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)