The Central Bank of Nigeria (CBN) has finally responded to the report of change in Nigeria’s exchange rate system, dismissing the report that naira has been “floated”.

According to information obtained on the Central Bank’s twitter handle at the early hours of Wednesday, the apex bank stated that “NO change” has been made on Nigeria’s exchange rate structure.

The Central Bank has quashed report of floating naira, but this may be a signal the CBN is trying to test run the possibility of floating the naira. On Tuesday, a new exchange rate was introduced at the Nigerian Ports. Analysts are of the opinion this may be another FX window in view.

The new exchange rate was reportedly introduced at the Lagos Port and the Nigeria Customs Service (NCS) was said to have commenced immediate implementation. Sources disclosed that all transactions and cargoes that were cleared at the port on Monday were already paying N326 per dollar.

Also, contrary to the central bank’s homepage on Tuesday which stated that the official rate was “market-determined”, the bank quickly reverted back to its original form on Wednesday, by providing details of the official bank exchange rate value.

Recalls that National Daily first on Tuesday that CBN may have accepted to float the exchange rate, judging from the information contained on the Bank’s website.

ALSO READ: Naira faces devaluation – investigation

The website has reflected this change since May, leading some analysts to opine that the CBN may have surreptitiously decided to float the naira.

As stated earlier, Nigeria operates multiple exchange rates structure, with the Central Bank’s official exchange rate currently selling for N306.95/$1. However, that is just the official bank rate which most Nigerians and businesses do not access.

Hence, the parallel market (Bureau De Change) is the most patronized for individuals, travellers and even businesses. In the parallel market, price is specifically determined by market forces of demand and supply.

Meanwhile, the CBN established the Investors’ & Exporters’ FX (I&E) window in 2017, a continued effort to deepen the foreign exchange (FX) market and accommodate all obligations.

You may be interested

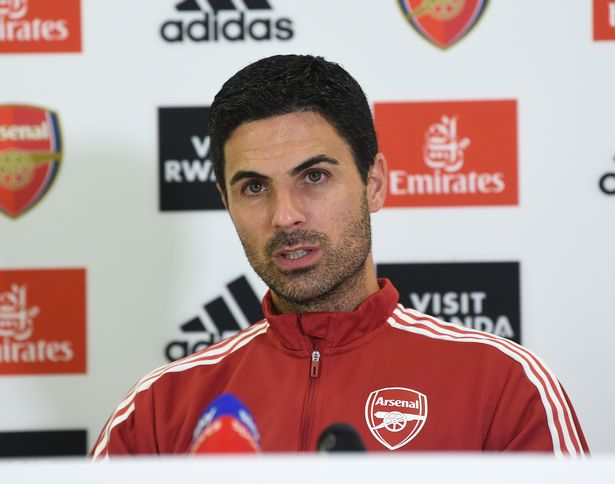

Arsenal Equal Chelsea’s London Derby Feat After 5-1 Win Vs Palace

Webby - December 21, 2024Arsenal equaled Chelsea’s London derby achievement following their 5-1 win against Crystal Palace in Saturday’s Premier League game at Selhurst…

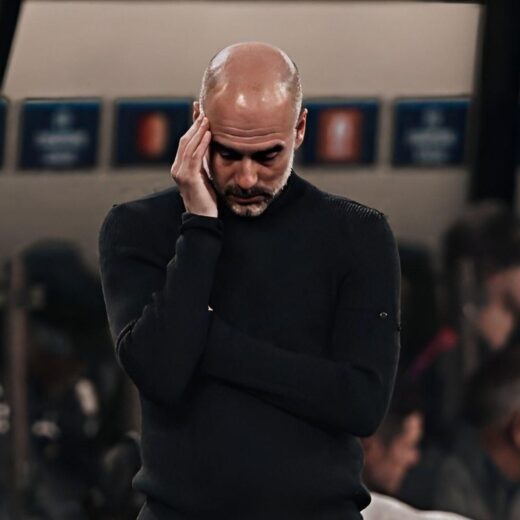

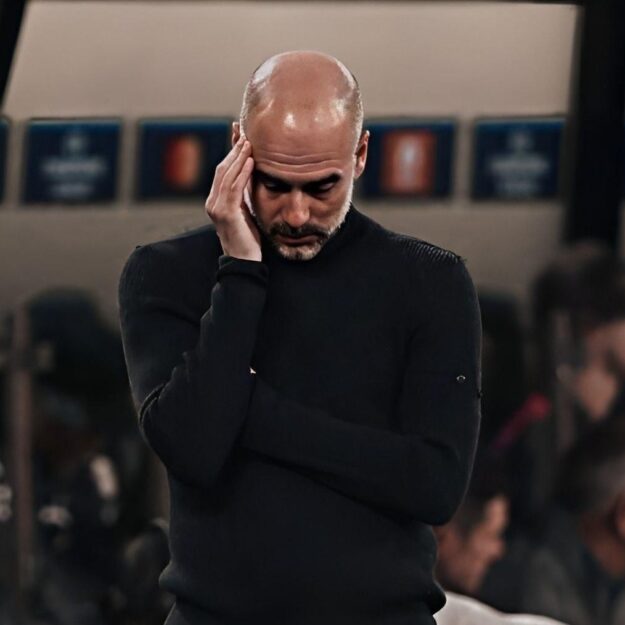

Haaland Backs Guardiola To Turn Man City’s Poor Form Around

Webby - December 21, 2024Erling Haaland had said he and his Manchester City teammates are still backing manager Pep Guardiola to turn the team’s…

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)