The Nigerian Stock Exchange (NSE) opened for the week on Monday still on a bearish trend and amid sell pressure.

Specifically, the All-Share Index declined by 1.26 per cent or 363.37 points to close at 28,484.44 compared with 28,847.81 achieved on Friday.

Also, the market capitalisation shed N141 billion, representing a dip of 1.30 per cent to close at N10.701 trillion against N10.842 trillion on Friday.

Market performance was influenced by price depreciation in medium and large capitalised stocks, among which are, Mobil Nigeria, Stanbic IBTC Holdings, Guinness Nigeria, Guaranty Trust Bank and PZ Cussons Nigeria.

Anaysts at APT Securities and Funds Limited said “equities continue in negative band as bearish trend continues and the ASI now down to 28,000 threshold.

“All sector indices closed in red led by the financial services sector on massive sell-offs. We expect further moderation of the ASI to be diluted by value investors’ position for long term.”

Market breadth remained negative with 11 gainers against 30 losers.

Neimeth International Pharmaceuticals and Okomu Oil recorded the highest price gain of 10 per cent, each to close at 55k and N77, respectively. AG Leventis & Company followed with a gain of 8.33 per cent, to close at 26k per share.

Africa Prudential appreciated by 7.91 per cent to close at N3.82, while Japaul Oil & Maritime Services went up by 7.69 per cent to close at 28k, per share.

On the other hand, Chams and NEM Insurance led the losers’ chart by 10 per cent, each to close at 36k and N2.25, respectively, while United Capital followed with a decline 9.38 per cent to close at N2.32, per share.

Goldlink Insurance declined by 8.70 per cent to close at 21k, while Jaiz Bank down by eight per cent, to close at 46k, per share.

The volume of shares traded closed lower with an exchange of 214.68 billion units, valued at N2.78 billion, and exchanged in 3,856 deals.

This was in contrast with a turnover of 235.23 million shares worth N1.36 billion traded in 3,130 deals on Friday.

UACN dominated trading activity with 41.29 million shares valued at N289.05 million.

Guaranty Trust Bank followed with 37.98 million shares worth N1.18 billion, while United Bank for Africa (UBA) traded 15.96 million shares valued at N96.83 million. Sterling Bank traded 13.03 million shares worth N34.5 million, Transcorp transacted 12.25 million shares valued at N14.19 million.

Meanwhile, the NSE on Monday delisted Newcrest ASL, which has 634 million share capital, from its daily official list of the Exchange.

Post Views: 69

You may be interested

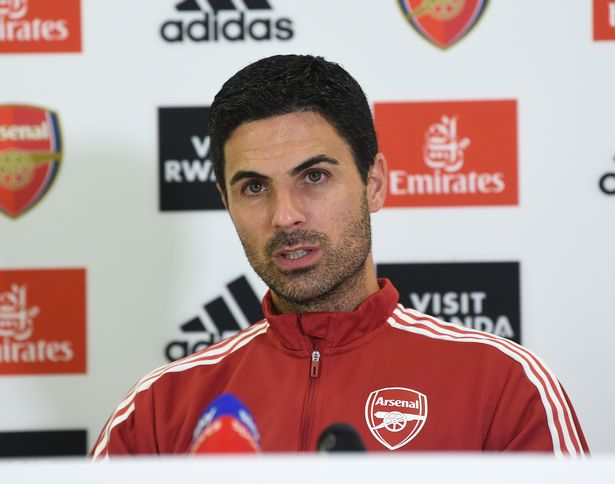

Arsenal Equal Chelsea’s London Derby Feat After 5-1 Win Vs Palace

Webby - December 21, 2024Arsenal equaled Chelsea’s London derby achievement following their 5-1 win against Crystal Palace in Saturday’s Premier League game at Selhurst…

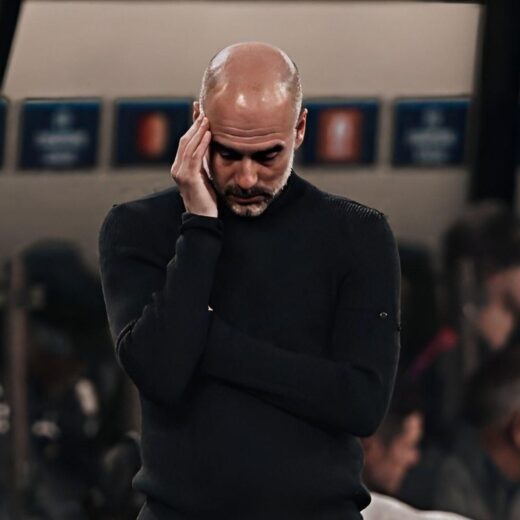

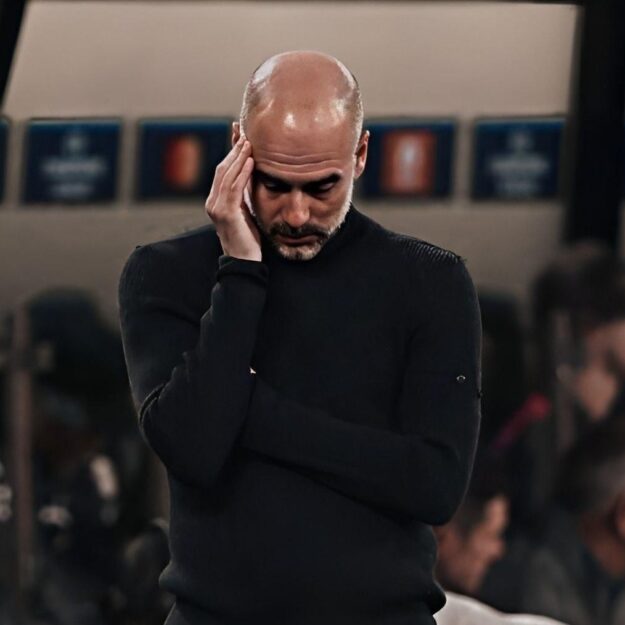

Haaland Backs Guardiola To Turn Man City’s Poor Form Around

Webby - December 21, 2024Erling Haaland had said he and his Manchester City teammates are still backing manager Pep Guardiola to turn the team’s…

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)