Nigerian equities suffered a major reduction in April as the fearful of falling prices at the stock market defied earnings reports and dividend recommendations. Quoted equities recorded net loss of N714 billion in April, increasing the net capital depreciation so far this year to N762 billion.

With the decline in April, average decline in investors’ portfolio over the past 16 months now stand at 25.03 per cent, with net decline of N2.65 trillion in total market value of quoted equities.

The All Share Index (ASI)- the main index that tracks share prices at the Nigerian Stock Exchange (NSE) closed April 2019 at 29,159.74 points as against its 2019’s opening index of 31,430.50 points, representing a four-month average return of -7.22 per cent.

ALSO READ: ABCON backs CBN’s clean note policy

Aggregate market value of all quoted equities at the NSE also dropped from the year’s opening value of N11.721 trillion to close April 2019 at N10.959 trillion, indicating net capital depreciation of N762 billion. The decline was exacerbated by widespread selloff in April with average decline of 6.06 per cent.

The ASI dropped from April’s opening index of 31,041.42 points to close the month at 29,159.74 points, representing average month-on-month decline of 6.06 per cent. Aggregate market value of all quoted equities also dropped from the month’s opening value of N11.672 trillion to close at N10.958 trillion. Fundamentally, the ASI and market value move simultaneously at the same value and in the same direction. However, addition and deduction of shares-through new listings and delisting, usually create temporary disparity between the two indices. When the impact of a new listing is fully absorbed by the market, the indices will converge and continue to trend on the same level.

With 57 decliners to 24 advancers, most sectoral indices closed negative during the month, despite subsisting dividend recommendations for the 2018 business year and the release of first quarter earnings reports by most quoted companies. The NSE Industrial Goods Index recorded average negative return of -7.36 per cent. The NSE Insurance Index dropped by 5.40 per cent. The NSE Consumer Goods Index posted a return of -5.38 per cent. The NSE Banking Index dipped by 4.48 per cent while the NSE Oil and Gas Index depreciated by 3.75 per cent during the month.

Chams Plc recorded the highest gain, in percentage terms, of 150 per cent to close April at 50 kobo per share. Dangote Flour Mills (DFM) Plc, which announced a major takeover offer during the period, rose by 84.31 per cent to close at N18.80 while Japaul Oil and Maritime Services appreciated by 65 per cent per cent to close at 33 kobo. On the downside, Associated Bus Company declined by 43.40 per cent to close at 30 kobo. Cement Company of Northern Nigeria (CCNN) followed with a loss of 29.65 per cent to close at N14 while Union Diagnostic & Clinical Services depreciated by 23.33 per cent to close at 23 kobo.

You may be interested

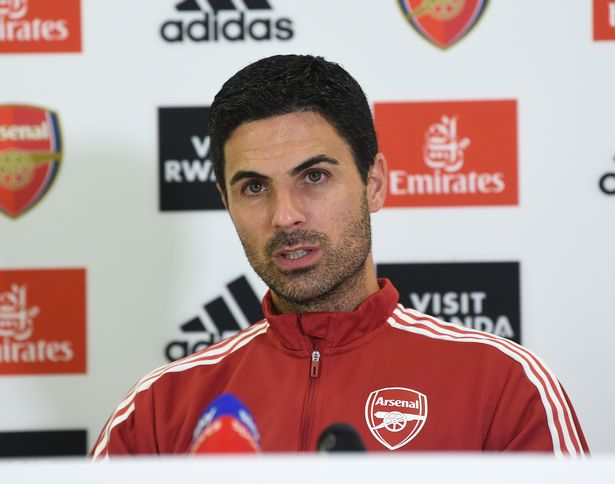

Arsenal Equal Chelsea’s London Derby Feat After 5-1 Win Vs Palace

Webby - December 21, 2024Arsenal equaled Chelsea’s London derby achievement following their 5-1 win against Crystal Palace in Saturday’s Premier League game at Selhurst…

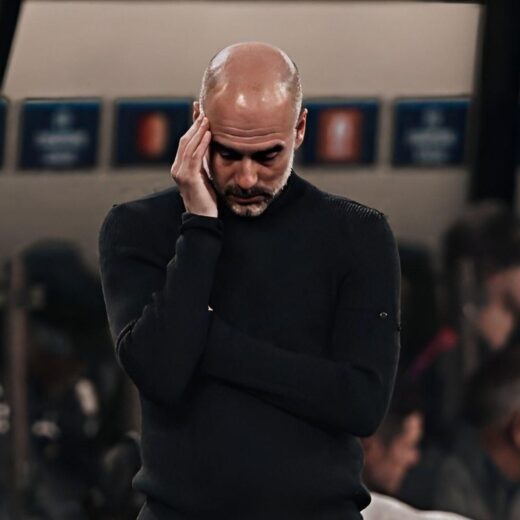

Haaland Backs Guardiola To Turn Man City’s Poor Form Around

Webby - December 21, 2024Erling Haaland had said he and his Manchester City teammates are still backing manager Pep Guardiola to turn the team’s…

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)