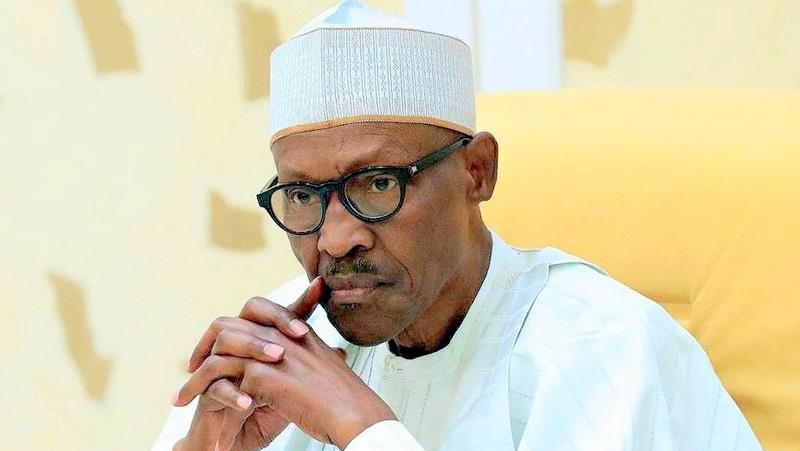

President Muhammadu Buhari led federal government has spent about $3.7 billion in foreign debt service since 2015, one of the highest from any democratically elected government.

Nigeria’s external debt stock stood at $27 billion in June 2019.

The Buhari administration has so far spent about $1.1 billion in foreign debt service this year. In 2018, the government spent about $1.4 billion in debt service, more than 3 times the $444 million it spent servicing foreign debts in 2017. The rising cost of debt service is a direct attribute of the government’s reliance on foreign loans as a means of funding government expenditure.

Nigeria’s fallen revenue following the crash in oil price has allowed President Buhari to rely mainly on foreign loans to fund government expenditure. As of June 2015, Nigeria’s foreign loans were about $10.5 billion mostly made up of multilateral and bilateral loans.

However, by June 2019, total foreign-denominated loans were $27 billion with $10.8 billion made up of Eurobonds. Commercial loans which include Eurobonds and Diaspora bonds make now make up about 42% of total foreign borrowings.

Critics of the government have complained about the government penchant for debts believing that it could put the future of younger Nigerians in jeopardy. Supporters of the government, however, believe the borrowing was necessary to invest in critical sectors of the economy particularly infrastructure.

The Finance Minister Zainab Ahmed however, believes the current debt profile is sustainable, comparing it to our GDP.

“Currently, Nigeria’s debt is at N25 trillion; that is about $83 billion. And at $83 billion, we are just at 18.99%…so 19% debt to GDP. I hear people say Nigeria has a debt problem. We don’t have a debt problem. What we have is a revenue challenge and the whole of this government is currently working on how to enhance our revenues, to ensure that we meet our obligation to service government as well as to service debt.”

Former Vice President and defeated PDP Presidential aspirant, Atiku Abubakar during the week piled criticism on the government’s borrowing.

“The fact that Nigeria currently budgets more money for debt servicing (N2.7 trillion), than we do on capital expenditure (N2.4 trillion) is already an indicator that we have borrowed more money than we can afford to borrow. And the thing is that debt servicing is not debt repayment. Debt servicing just means that we are paying the barest minimum allowable by our creditors.

The country’s ability to repay these loans will continue to be harder as it increases especially now that it is costing about 9%. The immediate risk for investors is the exchange rate which could be the first to suffer should the government struggle to repay its loans.

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

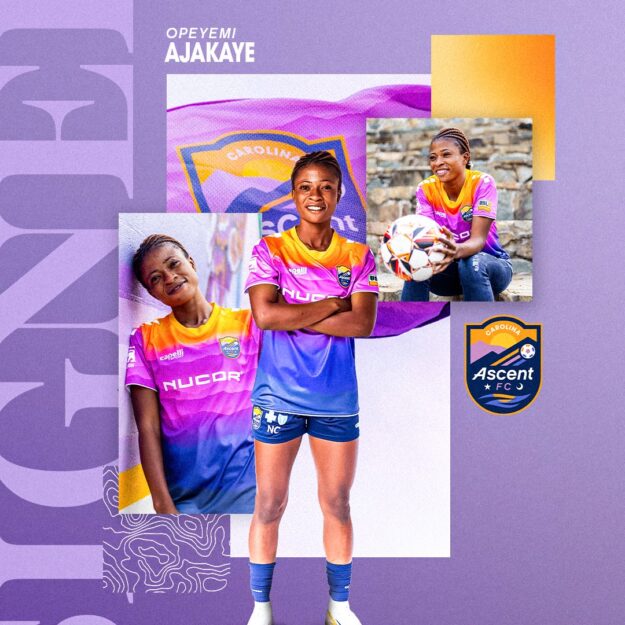

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

![INSECURITY: Gov. Ugwuanyi Employs 1,700 Forest Guards To Curb Herdsmen Menace [PHOTOS]](https://onlinenigeria.com/wp-content/uploads/2019/08/insecurity-gov-ugwuanyi-employs-1700-forest-guards-to-curb-herdsmen-menace-photos-150x150.jpg)

Leave a Comment