The latest Africa Risk-Reward Index report tracks the evolution of the investment landscape in major African markets, and this year’s edition marks several important and intriguing trends that impact investment strategy across the continent.

The fourth edition from specialist global risk consultancy Control Risks and independent global advisory firm Oxford Economics released on Wednesday offers a comprehensive and up-to-date view of the highly-dynamic business investment landscape in Africa.

The benchmark research recognises that elections in African markets can often fuel tensions and raise investment concerns. However, it also demonstrates how elections increasingly serve to stabilise Africa’s evolving political landscape.

“Do not get carried away by enthusiastic reform promises by assuming that reform-minded ‘strong-man’ leaders can push their way through free of any constraints,” Barnaby Fletcher, Associate Director Analyst at Control Risks, warns. “The real political lesson of recent years is to not underestimate the strength of counter-reform efforts by existing political structures, as well as the complexity of the undertaking,” he explains.

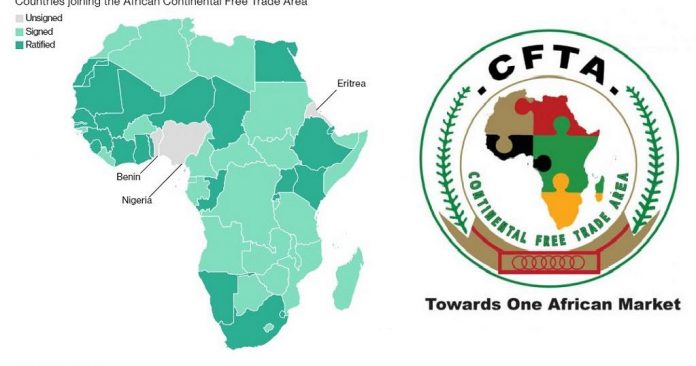

African investment has traditionally been dominated by its big economies but the long-awaited emergence of intercontinental trade blocs is shifting the balance of power. The paper explores the huge potential significance of introduction of the African Continental Free Trade Area (AfCFTA) in late May, while raising some concerns about its implementation. It also analyses the significant progress made by regional blocs such as the strengthening East African Community (EAC).

“The current edition of the index shows a slight increase in reward scores for some of the continent’s largest economies, including Nigeria, Angola, and Egypt, as the economic recoveries in these giants gain traction. However, the highest reward potential remains centred in the East Africa region, with expanding services and infrastructure development boosting demand and improving business environments,” says Jacques Nel, Chief Economist Southern & East Africa of Oxford Economics.

The comprehensive paper also tackles common misinterpretations of the external influences affecting African economies. Africa is no longer an even battlefield for US and Chinese players as commonly thought. Current US-Africa totals USD 39bn, while China-Africa represents more than USD 200bn, and EU-Africa trade is now over USD 300bn according to data revealed in the paper. The research also notes a surge of interest in Africa from smaller geopolitical players such as Russia, the Gulf states, Turkey, and India.

Africa remains a desirable investment destination with a young and increasingly urban demographic, a wealth of natural resources, and a proven ability to leapfrog technologies in areas such as telecommunications or finance. The growing competition for investment across the continent is helping to promote reform, which in turn encourages greater investment.

In Africa, diversification increasingly equals success and economies can no longer rely on merely holding the most mineral resources.

PV: 0

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)