Nigeria wants to offer naira futures of as long as 10 years to help cushion against foreign-exchange risks and attract longer-term funding to Africa’s top oil producer.

The Central Bank of Nigeria started selling foreign-currency futures contracts on the FMDQ Securities Exchange Plc in 2017 with a maximum duration of 13 months. This was to alleviate pressure on the naira by spreading dollar purchases over a period time, enabling investors to hedge against fluctuations in the naira, while also offering forwards that were introduced in 2011.

Market dealers and the FMDQ are “engaging the central bank to extend the curve of the FX futures because it will create stability for capital inflows into Nigeria,” Bola “Koko” Onadele, chief executive officer for the Lagos-based FMDQ said in an interview in Lagos, the nation’s commercial hub. “We wish for 5- to 10-year futures.”

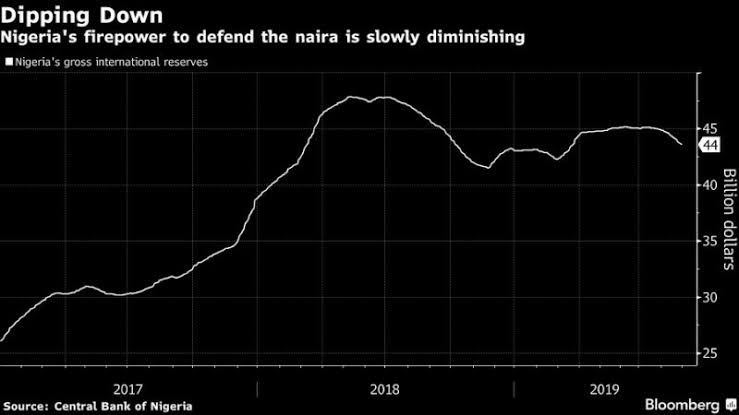

The exchange is seeking to bring more capital into the West Africa nation amid increasing pressure on the naira following a drop in Brent crude prices to below the government’s budgeted levels. Nigeria, which vies with South Africa as the continent’s biggest economy, relies on oil for 90% of its foreign-exchange earnings. Its external reserves have also been declining, curbing the central bank’s ability to prop up the currency.

“The availability of this FX futures product reduces, if not eliminates, the need to hoard FX and front-load on FX requirements,” said Onadele, who once worked as chief dealer at Citigroup Inc.’s Nigerian unit. “Foreign-portfolio investors tracking value will buy the futures, so will foreign direct investors and long-term borrowers in foreign currency.”

Nigeria operates a system of multiple exchange rates in a bid to control demand for dollars. The system, criticized by the International Monetary Fund, has kept the official rate at about 305 naira per dollar. It uses this to supply cheap foreign exchange to government departments and select companies, including fuel importers.

It created an importers and exporters window in 2017, in which the naira was allowed to weaken, and has been steady at 360 against the greenback, while forward rates suggest the local unit will weaken to 398.94 by the end of June. There’s also the Nafex rate, which references the interbank rate, and another set at regular auctions. The naira weakened 0.2% to 361.18 per dollar as of 9.02 a.m. in Lagos on Thursday.

“The best way to guard against exchange-rate volatility is to purchase futures contracts,” according to Onadele. “Longer-tenor futures will help to drive capital into Nigeria. It also provides opportunities for Nigerians in diaspora to bring their money home.”

FMDQ, which is transitioning to trade all securities including equities, from mainly fixed income and currency trading, is looking to introduce new products that will enable individuals and institutions to leverage their existing assets and make additional income, according to the CEO.

It plans to introduce repurchase agreements, a form of short-term borrowing for investors who hold government securities, by next year, he said. The product will benefit equities and debt investors as well as pension companies, which buy a lot of government debt and hold them until maturity because of the absence of a repo market.

“After you have bought bonds and you need cash to settle an imminent obligation, you should be able to use the asset to quickly raise cash for the short term, and then buy back your asset afterwards,” Onadele said. “With a repo market, they can improve on the returns on their investments by buying repos, accessing new cash and reinvesting this new cash.”

You may be interested

Ighalo Provides Assist As Relegation-Threatened Al Wehda Claim Away Win

Webby - March 14, 2025Odion Ighalo had an assist as struggling Al Wehda defeated Al Khaleej 2-0 in the Saudi Professional League on Friday.…

NPFL: Desouza, Ikhenoba Scoop February Awards

Webby - March 14, 2025Abia Warriors forward Antoine Desouza and Bendel Insurance interim head coach Greg Ikhenoba have won the Nigeria Premier Football League,…

Dewsbury-Hall: Chelsea Can Lift Europa Conference League Trophy

Webby - March 14, 2025Chelsea match-winner Kiernan Dewsbury-Hall says he’s optimistic the Blues will lift the Europa Conference League.Recall that Dewsbury-Hall netted the only…

![Nigeria May Introduce Contracts to Manage Naira Risk for a Decade [See Graphics]](https://www.onlinenigeria.com/wp-content/uploads/2019/02/on-logo.png)

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

![UNN Unveils Nigeria’s First Five-Seater Electric Car, Names It “Lion Ozumba 551” [Photo]](https://onlinenigeria.com/wp-content/uploads/2019/07/unn-unveils-nigerias-first-five-seater-electric-car-names-it-lion-ozumba-551-photo-150x150.jpg)

![Nigeria May Introduce Contracts to Manage Naira Risk for a Decade [See Graphics]](https://onlinenigeria.com/wp-content/uploads/2019/02/on-logo.png)