The Central Bank of Nigeria (CBN), has injected 297.92 million dollars into the Retail Secondary Market Intervention Sales (SMIS).

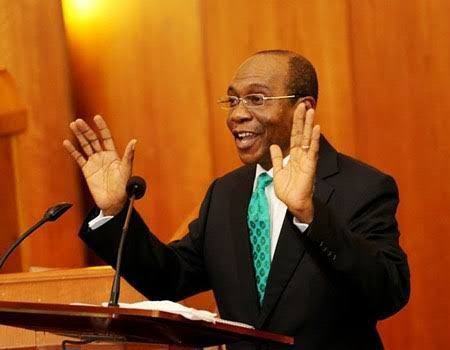

The bank’s Director, Corporate Communications Department, Mr Isaac Okorafor made this known in a statement in Abuja on Friday.

Okafor disclosed that CBN also injected CNY21.2million in the spot and short-tenured forwards segment of the inter-bank foreign market.

According to him, the United States dollars-denominated transactions are to meet requests in the agricultural and raw materials sectors, while those in Chinese Yuan are for Renminbi-denominated Letters of Credit.

The director reiterated that the bank’s management was satisfied with the continued stability in the foreign exchange market. He assured that the CBN remained committed to meeting foreign exchange needs of all sectors of the economy.

Meanwhile, N358 was exchanged to a dollar, while CNY1 exchanged at N46 at the Bureau De Change (BDC) segment of the foreign exchange market on Friday.

Vanguard

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)