The new majority core investor in Forte Oil Plc may soon launch a mandatory tender offer (MTO) to take over ordinary shares held by minority shareholders in line with extant rules at the Nigerian capital market.

Sources in the know at the weekend told The Nation that the new core investor in Forte Oil, Ignite Investments and Commodities Limited, may launch a tender offer of up to N22.3 billion to takeover shares held by minority shareholders in the downstream oil company.

Ignite Investments and Commodities Limited led by Prudent Energy Services Limited last week completed the acquisition of 74.02 per cent majority equity stake in Forte Oil from the company’s erstwhile chairman, Mr. Femi Otedola.

The transaction was valued at about N64 billion. Ignite Investments and Commodities Limited immediately took over the management of the company, new managing director and chief financial officer for the company. The new core investor has also made changes to the board of the company to reflect the new ownership structure.

While details of the MTO remain sketchy at the weekend, sources in the know said the new core investor’s capital market advisers had laid out the inevitability of a takeover bid for minority shares to the new investor.

The MTO is in line with the provision of the Section 131 of the Investment and Securities Act (ISA) and Rule 445 of SEC, which make it mandatory for any institution or person that acquires at least 30 per cent of a company to make an MTO to other minority shareholders.

Ignite confirmed that it acquired 74.02 per cent equity stake in Forte Oil, which translates to about 964.097 million ordinary shares of 50 kobo each. Forte Oil has total issued share capital and outstanding shares of 1.302 billion ordinary shares of 50 kobo each. Minority shareholders thus hold 338.38 million ordinary shares of 50 kobo each.

Regulatory filing at the Nigerian Stock Exchange (NSE) indicated that the transaction price for the Ignite-Otedola transaction was N66.01 per share. However, the shares were transferred through cross deals at the negotiated window of the NSE at N66.25 per share.

Read Also: UPDATED: Otedola exits Forte Oil, sells 75% stake

Otedola had in December 2018 announced that he planned to sell his 75 per cent majority equity stake in Forte Oil to Prudent Energy, which will be investing through Ignite Investments and Commodities Limited.

Under the terms of an MTO, Ignite is expected to offer to buy the minority shares at the same price it used for the Otedola transaction.

Sources, who preferred anonymity because of potential conflict of interests, however differed on whether Ignite will follow through with a full tender offer or opt to acquire certain percentage of existing minority shareholdings and the relevant price for the MTO.

Many sources said extant rules make it mandatory for the new core investor to make a full tender offer to all minority shareholders at the transaction price for the acquisition that triggered the MTO. They insisted that this was the position of the law and general intent, which was to protect minority shareholders from bogus acquisition deals.

The sources said the transaction price is taken as a fair value for the company, and it takes precedence over current market value which may not reflect the true value and worth of the company. Forte Oil’s share price closed weekend at N31.20 per share, 52.7 per cent below the Iginte-Otedola’s transaction price.

A source, however, said the new core investor may adopt a valuation based on the average trading share price of the company over a given period, usually between 30 days and 60 days. The source also said the new investor may opt for a reasonable percentage of the minority shareholdings, if it does not desire full takeover of the company.

Chairman, Ignite Investments and Commodities Limited, Mr Abdulwasiu Sowami, said the acquisition was a strategic investment in his company’s quest continuously to add value to the Nigerian oil and gas industry.

Sowami, who is also the chief executive officer of Prudent Energy Services Limited, said Forte Oil’s next phase of growth will focus on increasing volumes, diversifying business operations, widening distribution networks and extracting potential synergies with partners.

“We look forward to working as part of the Forte Oil family to achieve this growth,” Sowami said.

You may be interested

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

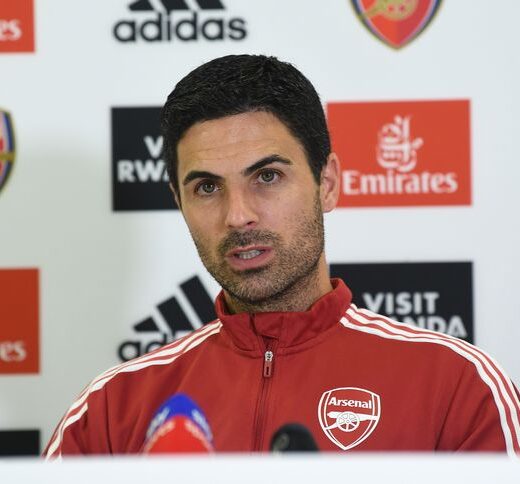

Arteta Provides Injury Updates On Five Arsenal Players Ahead Palace Clash

Webby - December 20, 2024Arsenal manager Mikel Arteta has revealed that Declan Rice and Riccardo Calafiori are both available to be in the Gunners…

Carabao Cup: Spurs Edge Man United In Seven-Goal Thriller To Reach Semi-finals

Webby - December 19, 2024Tottenham Hotspur edged Manchester United 4-3 in the quarter-finals of the Carabao Cup on Thursday.Spurs raced to a 3-0 lead…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

![EFCC Parades Naira Marley, Zlatan Ibile And Other Suspected Yahoo Boys [Photos]](https://onlinenigeria.com/wp-content/uploads/2019/05/efcc-parades-naira-marley-zlatan-ibile-and-other-suspected-yahoo-boys-photos-150x150.jpg)

![Impeached Kogi Deputy Governor, Simon Achuba Forgets Charms In Government House [Photo]](https://onlinenigeria.com/wp-content/uploads/2019/10/impeached-kogi-deputy-governor-simon-achuba-forgets-charms-in-government-house-photo-150x150.jpg)