The parallel market exchange rate has experienced a significant decline, plummeting to a record low of N1960 per Euro, driven by persistent demand pressures that continue to erode the currency’s value.

This marks a notable decrease of 5.36% or N105 compared to the N1,855 rate recorded the previous day at the black market.

This depreciation stands as an unprecedented occurrence, representing the lowest point in the historical performance of the Naira against the Euro.

Concurrently, black-market exchange rates have continued to witness the devaluation of the Nigerian Naira, exacerbated by a substantial surge in inflation, as reported by the National Bureau of Statistics (NBS) for January 2024.

The inflation rate surged to 29.90 per cent, indicating a significant rise from the 28.92% recorded in the previous month.

Similarly, the Naira depreciated against dollar in the parallel forex market, where forex is unofficially traded, with the exchange rate quoted at N1,880/$1, reflecting a 2.66% decrease from the N1,830 rate it closed at the previous day.

Additionally, the Great British Pound (GBP) stood at £1/N2260, a decline from £1/N2,210 recorded the previous day, this marks a notable decrease of 2.21% compared to the N2,210 rate recorded the previous day.

READ ALSO: Naira reverses losses, strengthens at parallel market

It has been a tumultuous twenty-four hours on the renowned cryptocurrency platform, Binance, after the exchange rate between the naira and the popular stablecoin, Tether (USDT), plummeted to approximately N1900/USDT before subsequently rising to N1354.3.

However, by 7 am on Thursday, February 22, the naira was trading between N1680-N1710/$1 USDT.

This situation arises amid several reports of a crackdown on cryptocurrency trading, which some authorities view as a significant contributing factor to the rapid depreciation of the naira.

Tether (USDT) is a stablecoin used as a medium of exchange for cryptocurrency traders looking to trade their local currency against the dollar. One USDT is equivalent to $1.

This dramatic drop and subsequent recovery underscore the volatile nature of cryptocurrency markets, especially in the context of Nigeria’s current economic climate.

The exact cause of the wild volatility experienced in the last 24 hours remains unclear, even as some attribute it to a broader crackdown on cryptocurrency trading by certain authorities, who argue that such activities have been contributing to the rapid devaluation of the naira.

You may be interested

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

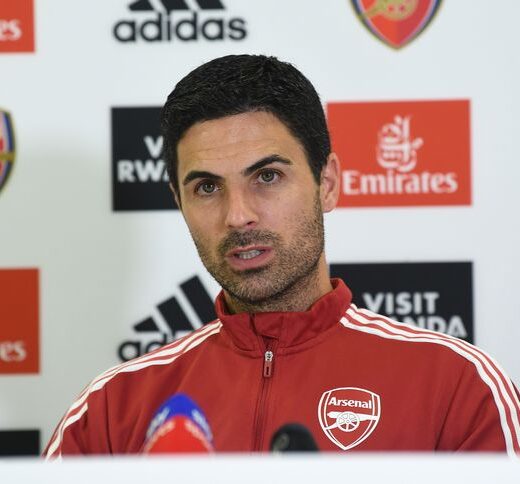

Arteta Provides Injury Updates On Five Arsenal Players Ahead Palace Clash

Webby - December 20, 2024Arsenal manager Mikel Arteta has revealed that Declan Rice and Riccardo Calafiori are both available to be in the Gunners…

Carabao Cup: Spurs Edge Man United In Seven-Goal Thriller To Reach Semi-finals

Webby - December 19, 2024Tottenham Hotspur edged Manchester United 4-3 in the quarter-finals of the Carabao Cup on Thursday.Spurs raced to a 3-0 lead…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)