The Central Bank of Nigeria (CBN) spent a whopping $11.81 billion in the first 3 months of 2019 to stabilize the Naira against the US Dollar and other international currencies at the forex market.

This information is contained in the CBN Quarterly Economic Report which was recently published by the apex bank.

In the first quarter of 2019, a total of US$11.81 billion was sold by the CBN to authorised dealers in the first quarter. This represents a 10.2% increase above the level in the fourth quarter of 2018.

Compared to the preceding quarter, the development reflected the increase in inter-bank sales and swaps transactions in the review quarter.

Out of the total CBN injection, foreign exchange forwards disbursed at maturity was US$2.30 billion. This represents about 19.5% of the total injection.

Sales to Bureau De Change (BDCs) constitutes the highest for the quarter with $3.64 billion, representing about 30.8%.

The I&E window, where investors come to buy and sell forex received $1.53 billion, and this represents 13% of the total.

ALSO READ: NSE loses N41bn in April as foreign investors dump stocks

Interbank forex sales dropped by 26% for the quarter, from $0.75 billion to $0.55 billion (4.6% of total).

The external sector remained relatively stable as a result of the increase in non-oil receipts in the review quarter. However, the international price and local production of crude oil declined. Aggregate foreign exchange inflow through the CBN amounted to US$18.64 billion while aggregate outflow through the CBN, rose to US$17.29 billion.

Overall, Foreign exchange inflow and outflow through the CBN rose, resulting in a net inflow of US$1.35 billion in Q1 of 2019

In order to defend the naira, the CBN has to frequently blow forex into the economy. Doing this helps to ease-off the forex demand pressure. So far, the CBN sustained its interventions at both the inter-bank and the BDC segments of the foreign exchange market in the review quarter.

However, the report shows that the average exchange rate of the naira vis-à-vis the US dollar at the inter-bank segment depreciated by 0.04% to N306.84/US$, relative to the level at end-December 2018.

At the BDCs segment, the average exchange rate, appreciated by 0.7% above the level in the preceding quarter to N359.97/US$. Similarly, at the I&E window, the average exchange rate stood at N362.07/US$, representing 0.6% appreciation relative to the level in the preceding quarter.

Consequently, the premium between the average inter-bank and BDC rates narrowed by 0.8% point in the review quarter, from 18.1% points at the end of the fourth quarter of2018 to 17.3% in the first quarter of 2019.

Earlier in the week, Nigeria’s external reserves hit the $45 billion. By burning through reserves, the CBN sacrifices forex savings for naira stability hoping that this will help drive down the inflation rate.

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

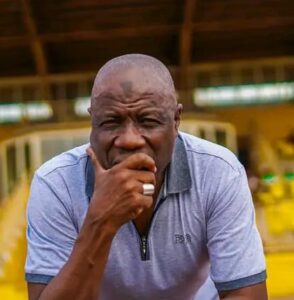

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)