The Nigerian Stock Exchange (NSE) market indices on Tuesday sustained growth, posting a marginal gain of 0.14 per cent in a cautious trading.

Specifically, the All-Share Index rose by 43.72 points or 0.14 per cent to close at 32,173.66 against 32,129.94 achieved on Monday.

Also, the market capitalisation which opened at N11.981 trillion increased by N17 billion to close at N11.998 trillion.

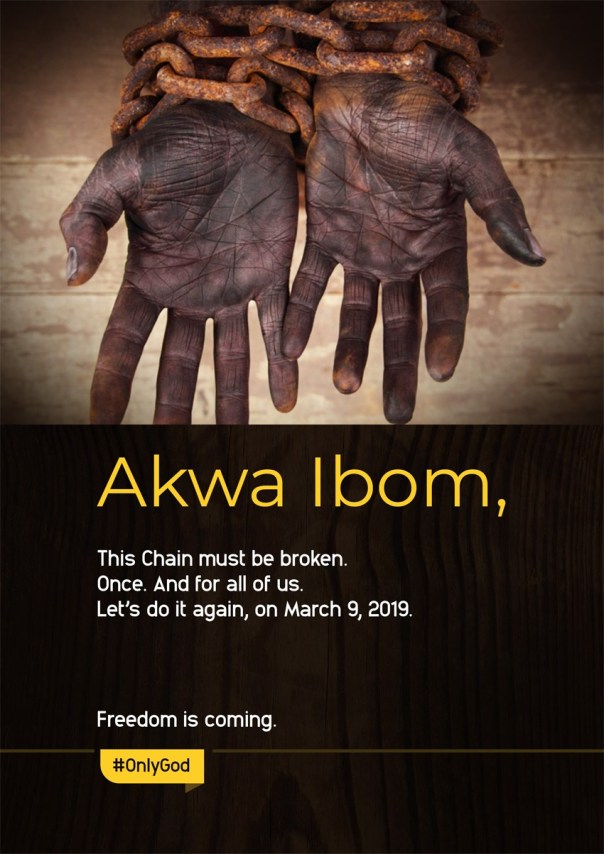

Analysts at Cordros Capital said that investors should tread cautious due to sensitive political landscape.

“Amidst the still sensitive political landscape, we still hold the view that the blend of compelling valuation story, together with positive macroeconomic picture, leaves scope for market recovery in the medium-to-long term.

“However, we guide investors to tread a cautious trading path in the short term,” they said.

A breakdown of the price movement table shows that NASCON recorded the highest price gain of 80k to lead the gainers’ table to close at N20 per share.

Dangote Flour followed with a gain of 60k to close at N11, while Guaranty Trust Bank appreciated by 40k to close at N37.60 per share.

Union Bank of Nigeria grew by 30k to close at N7, while Zenith Bank added 20k to close at N24.70 per share.

Conversely, Dangote Cement topped the laggards’ table, shedding N1 to close at N196 per share.

Redstar Express trailed with a loss of 50k to close at N5, while Caverton lost 15k to close at N2.30 per share.

Custodian and Investment also declined by 15k to close at N5.90, while UACN went down by 15k to close at N8.10 per share.

Also, the volume of shares traded improved by 75.45 per cent, while the value of shares transacted rose by 32.57 per cent.

Consequently, investors bought and sold 400.87 million shares worth N3.46 billion traded in 3,885 deals.

This was in contrast with a turnover of 228.48 million shares valued at N2.61 billion traded in 3,544 deals on Monday.

Diamond Bank was the most active stock for the day, trading 119.79 million shares worth N299.33 million.

FBN Holdings followed with an account of 44.39 million shares valued at N358.98 million, while United Bank for Africa sold 40.82 million shares worth N314.48 million.

Guaranty Trust Bank traded 32.51 million shares valued at N1.22 billion, while Zenith Bank sold 24.40 million shares worth N604.99 million.

(NAN)

You may be interested

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

Ghana Miss Out On AFCON 2025 Qualification After Draw With Angola

Webby - November 15, 2024Black Stars of Ghana’s hopes of qualifying for next year’s AFCON was ended after they played a 1-1 draw away…

‘It Was A Fair Result’ — Troost-Ekong Reacts To Super Eagles Stalemate Vs Benin Republic

Webby - November 15, 2024Super Eagles captain William Troost-Ekong claimed the Super Eagles deserved a point from their 2025 Africa Cup of Nations qualifying…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

Leave a Comment