The Central Bank of Nigeria (CBN) directive for banks not to deposit funds above N2 billion at its Standing Deposit Facility (SDF) window will free over N750 billion for loans, it was learnt on Thursday.

Commercial banks are expected to deposit excess funds at the CBN daily and earn interests on such funds, The Nation learnt.

The guideline, issued on Wednesday, took effect yesterday. It reduced the remunerable daily placement of SDF from N7.5 billion to N2 billion.

SDF is the excess reserve funds that banks deposit at the SDF window of the CBN at the end of each business day. The Standing Lending Facility (SLF) is fund borrowed by banks from the apex bank to square up their positions in the market.

The SDR attracts interest rate of Monetary Policy Rate (MPR) minus 500 basis points, which is 8.5 per cent per annum up to the limit of N2 billion. Any deposit over and above the maximum will attract zero interest rate.

CBN Director Financial Markets Department Angela Sere-Ejembi said renumerable daily placements by banks to the SDF shall not exceed N2 billion.

She said: “With reference to the circular to all banks and discount houses on guidelines for accessing the CBN Standing Deposit Facility.

“The SDF deposit of N2 billion shall be enumerated at the interest rate prescribed by the Monetary Policy Committee from time to time. Any deposit by a bank in excess of N2 billion shall not be enumerated. The provisions of the circular take effect from today.”

The Head, Currencies Market at Ecobank Nigeria, Olakunle Ezun, said the CBN had earlier announced regulatory guidelines to stimulate lending to Small and Medium Enterprises (SME), retail, mortgage and consumer lending with mandate to banks to maintain a minimum loan to deposit ratio of 60 per cent (compared to current industry average Loan to Deposit Ratio (LDR) of 58.5 per cent as at May 2019 and regulatory maximum of 80 per cent), subject to quarterly review.

By this regulation, the CBN aims to improve market liquidity and, subsequently, encourage deposit money banks to increase lending to the productive sector of the economy. This comes with additional incentive of a weight of 150 per cent to the preferred sectors in the computation of LDR.

Ezun said the impact of the new guideline on SDF would force the banks to carry out their core responsibility of intermediation (the circular capped the preference of banks to keep idle balances at the CBN in the SDF window).

“In the immediate, the money market liquidity is expected to rise by N750 billion, thereby lowering inter-bank market rates by 150 basis point.

“The CBN’s recent move could be positive, as we expect improved lending to the productive sector and reveals the risk appetite for the productive sectors of the economy,” Ezun said.

However, depending on market reaction and behaviour, the inter-bank money market rates could further drop and was average two per cent to five per cent in the days ahead.

It is currently trading at a weekly average of 4.85 per cent for overnight rate and 12.25 per cent on 90-day tenored funds.

According to Ezun, the secondary market (discount) rate on treasury bill was expected to trade between eight per cent to 10 per cent for 91-day maturity and below and 11.5 per cent for tenor above 91-day maturity.

He said the secondary market yield on bond is expected to moderate downward to sub 13.5 per cent for tenor above five-year in short term.

Ezun said that while the CBN’s reason for the circular is to encourage bank to lend to the productive sector, it is not clear how the apex bank intends to achieve this objective.

He said: “Given internal risk framework of most bank and their disposition to increase lending to riskier borrowers, potentially with looser underwriting or under-pricing outlook, the risk acceptance framework will have to come to play.

“While the liquidity in the market will rise, the liquidity could be locked up in a large portfolio of government securities in contrast to the overall objective of lending to the real sector.”

He explained that in the longer term, more stringent regulations can be positive for the economy but negative for the lending institution while stringent regulations can force bank to increase their risk appetite, which could lead to higher non-performing loan and further deteriorate the industry’s asset quality.

You may be interested

NPFL: Finidi Satisfied With Rivers United’s Draw Vs Remo Stars

Webby - November 18, 2024Rivers United head coach, Finidi George has expressed satisfaction with his team’s performance in Sunday’s Nigeria Premier Football League (NPFL)…

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

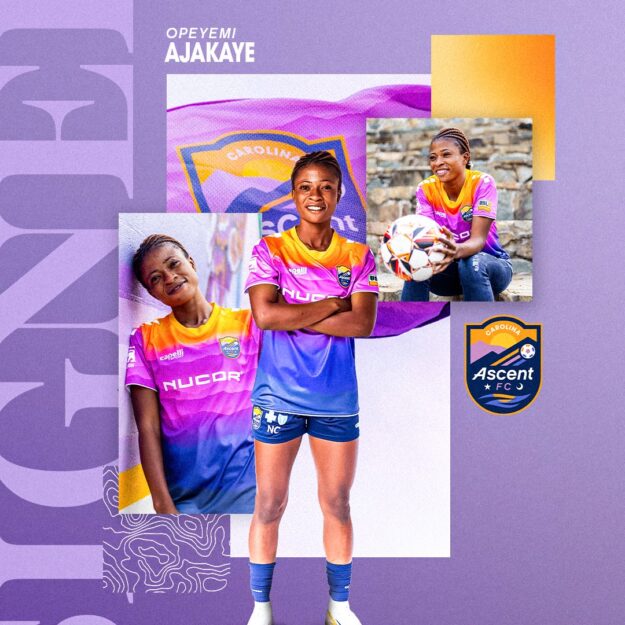

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)