With fears rife over an imminent global economic recession, experts have expressed mixed feelings on how it may affect Nigeria’s economy already suffering a lot of headwinds, report Ibrahim Apekhade Yusuf and Medinat Kanabe

As Nigeria immune from the impending global financial crisis as accentuated by the trade wars between the two major economic powers including the USA and China? Are the fears about a global meltdown as experienced a decade ago founded? Are there ominous signs?

The foregoing questions are some of the worries that have preoccupied the minds of well-meaning Nigerians in the last couple of days now. Indeed with the latent fears over another imminent global economic crunch, many countries of the world are preparing ahead for any eventualities.

While analysts have expressed mixed reactions as to the extent to which the outcome of the trade wars can adversely affect Nigeria, they however did not foreclose the possibility.

Clear and present danger over recession

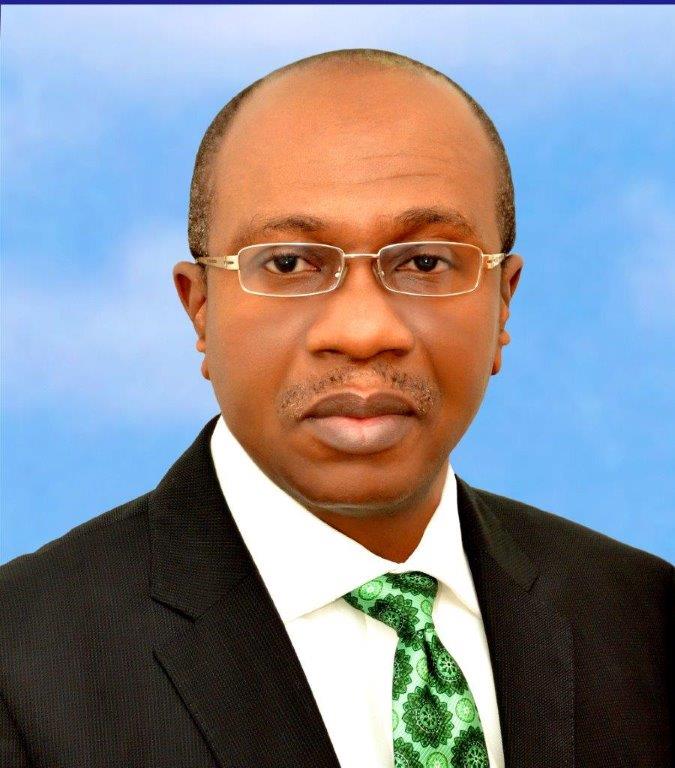

One man who should know better is the governor of Central Bank of Nigeria (CBN), Godwin Emefiele. He spoke of fears of another recession if measures are not put in place to combat the high rate of unemployment and other economic crisis.

Emefiele gave this hint penultimate Wednesday at the University of Benin, while delivering a lecture titled: ‘Beyond the Global Financial Crisis: Monetary Policy under Global Uncertainty.’

According to him, monetary and fiscal policy authority must be ready to challenge the situation and begin to think of what can be done to tackle the situation.

The CBN governor said: “From some of my concluding remarks, you may have observed whether you like it or not, there is global uncertainty that will unfortunately most certainly, lead to another crisis.

“The question could be, how are we, as Nigerians, particularly our leaders, I am talking of Monetary and Fiscal Policy Authority, how are we preparing our country for the next set of crisis?”

He said “we have luckily exited recession. We have seen inflation pending downward to about 18.72 percent in 2017 to about 11. 37 percent today. We see reserve moving up, exchange rate stabilizing but unfortunately, we still have issue and those issues bother on unemployment rate.”

He assured that CBN will continue to take proactive approach in mitigating the likely adverse effects that may emanate from external headwinds.

While the CBN governor was rather downcast in his forecast, the President of the Association of Bureaux De Change Operators of Nigeria (ABCON), Alhaji Aminu Gwadabe, at the weekend was optimistic that the country was not under any risk, especially of a global recession.

“As far as I’m concerned, there is really no cause for alarm. The forex market has been relatively stable. From what we can see the economic managers have got a solid rein on the workings of the economy. The new government as just been sworn in and have since hit the ground running,” he assured.

Going down memory lane, the ABCON boss said, “One of the factors that helped the country from exiting recession in the past was a single exchange rate for the market, ensuring that naira should not be more than N400 to a dollar and this was one of the first thing we did as an association, to checkmate the spike and the weakness of the naira. Also, as stakeholders in the market, we have helped the Central Bank of Nigeria in ensuring that people have readily foreign exchange accessibility, like you said our number is about 3,500. None of the banks even have up to 1000 outlets in the entire country.

“In Lagos alone, we have about 1,700 BDCs. So, we are all over the place ensuring liquidity. Right now, the market is even shocked up, because the parallel market rate is below the rate we are buying from the CBN. We are currently buying at N358 to the dollar for working customers that come, some even N355 but we are going to the CBN window at N360 to a dollar. So, it is even becoming impossible for people to go to CBN window and come out and sale to make margin because of the parallel market rate is even far below the selling rate of the CBN to the BDC sub sector.”

2019 outlook

In 2019, by broad consensus of global economic institutions, the world economy will slow. However, the issue is where and by how much. Reporting on this, the London-based magazine, The Economist, noted that economists at Investment Bank, JP Morgan developed their model based only on the historical predictive power of the stock market, credit spreads and the yield curve. This implies a probability of a recession in the United States in 2019 which could be as high as 91%.

According to economic watchers, in Nigeria, a lot will depend on the condition of the international oil market. If the global economy slumps, oil prices will come under severe pressure and rising dollar would result in oil price decline.

Besides, the experts inferred that there are strong reasons to believe that monetary conditions will tighten in the year as CBN seeks to rein in liquidity just as there are concerns that this might not be adequate to refrain the naira from falling against major foreign currencies.

Rising food prices from low harvests as a result of the herdsmen conflict and severe floods in 2018, and the implementation of the new minimum wage are expected to increase inflationary pressures during the year which could lead to tighter monetary policy.

‘Recession is a possibility’

In the view of Mr. Victor Ndukauba, Deputy Managing Director, Afrinvest West Africa Limited, the fear of global recession is not likely but a global slowdown in growth is certain under the circumstance.

While making oblique reference to the trade warfare between the USA and China, Ndukauba said, “The risk is possibly driven by the US, the trade wars on one hand between the US and China fighting over, you know, the trade balance and trade deficit and more recently the conflict between Mexico and Canada. So, I think that’s the real threat to global slowdown because between the US and China these are the two countries that are responsible for nearly 40% of all trade flows and perhaps even more in terms of the global GDP.”

On whether the risk of the global slowdown in growth is sufficient to push the global economy into a recession, he said it is a possibility. “That might be possible but I think if you follow the top global issues though, the more critical thing for us is still the domestic challenges confronting us daily.”

Raising some posers, the Afrinvest boss said, “What is the risk of the slow down on all titles, positive or negative and how do we put that side by side the expectations for the conflict in the Middle- East and how long will the escalation in Iran and the US versus North Korea last? For me, issues are even more fundamental and they are more domestic than external.”

While attempting a prognosis of the issues bedeviling the nation’s fledging economy, he said, “Growth is at 2% or thereabouts and the security growth is very weak at 2% where our population is still growing at 2.6, 2.7 so that is part of the problem with respect to an expansion in poverty. What drives growth in Nigeria is not so much what happens on the external sector and the best you can have is oils prices is still where it was last year which is at an average of 70 barrel or more. But even with that we saw that revenue underperformed by 45% so unless something significant happens in terms of output, significant output in oil volumes and that oil prices stay high we are still going to struggle in respect to revenue and there is only so much you can flog in terms of trying to get the economy to swipe as we produce the taxes.”

Pressed further, he said, some of the issues are more domestic than external. “As a government we need to look at. I think the focus now has to be more on growth because that is where the real need is. Unemployment indices is a disaster at 26% or thereabout. So we really need to address the Issues and even those external developments are always the key risk factor but I think regardless we still have good examples we can draw from in Africa. Ethiopia is doing maybe 10% and Rwanda is doing something similar so I think there are pockets of excellence even despite the global headwinds. As far as I’m concerned, there are very clear and present dangers really of a possible recession. By the way, a recession is officially described as two successive regimes of negative GDP flow. So if you see a contraction, then there is a problem.

“When you look at the 2% GDP growth, there is only really one sector that made the difference and that is the telecoms. ICT attracted about at 10% GDP growth. Every other sector hardly posed such impressive outcomes. At 6% and services was more or less negative, manufacturing was down. Those are the issues really confronting us at this point in time.”

How USA China trade war will aid global recession

There are worries that a further escalation of the trade war between the United States and China could drag the world economy into a recession, according to Janus Henderson Investors.

This is a potential for a “near-term, very painful escalation” of the trade tensions, which could weigh on the tech sector and slow global growth, said Richard Clode, a portfolio manager on the global technology team at Janus Henderson.

“I’m worried about the trade war,” Clode said at a media round table on disruption and sustainable investing in Hong Kong. “Rising protectionism, 25 per cent tariffs on Chinese goods is going to have huge implications for the global economy and could ultimately bring us into a recession.”

You may be interested

Arsenal Equal Chelsea’s London Derby Feat After 5-1 Win Vs Palace

Webby - December 21, 2024Arsenal equaled Chelsea’s London derby achievement following their 5-1 win against Crystal Palace in Saturday’s Premier League game at Selhurst…

Haaland Backs Guardiola To Turn Man City’s Poor Form Around

Webby - December 21, 2024Erling Haaland had said he and his Manchester City teammates are still backing manager Pep Guardiola to turn the team’s…

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

![[PHOTOS] Turkey receive First shipment of Russian S-400s, 2nd is planned ~ Ankara](https://onlinenigeria.com/wp-content/uploads/2019/07/photos-turkey-receive-first-shipment-of-russian-s-400s-2nd-is-planned-ankara-150x150.jpg)

![“The Time Has Come For Me To Say Goodbye” – Daddy Freeze Leaves Cool FM After 20 Years [Video]](https://onlinenigeria.com/wp-content/uploads/2020/03/the-time-has-come-for-me-to-say-goodbye-daddy-freeze-leaves-cool-fm-after-20-years-video-150x150.jpg)