Royal Exchange Plc said it is currently focused on achieving sustainable growth through deepening of its revenue base, improving service delivery and its support systems as well as keeping its management costs in check.

The company, also said it has set for itself the goal to continuously redefine, reinvent and differentiate itself in the marketplace.

Royal Exchange Chairman, Mr Kenny Odogwu, who disclosed these while addressing shareholders at the 50th annual general meeting (AGM) of the company held in Lagos recently, said despite the very harsh operating environment, the group was able to deliver a better result in 2018 against the previous year’s adding that this was achieved through cost optimisation initiatives, innovation in key categories and extensive retail market expansion as well as by participating in large-ticket financial transactions.

According to Odogwu, Royal Exchange Plc, envisions a situation where the retail insurance market should be able to contribute between 50-60 per cent of its revenues in the future, noting that the retail market is the future of insurance in Nigeria, considering the population of the country.

He further added that with the recent approval secured by the company from the National Insurance Commission (NAICOM) to undertake agricultural insurance, Royal Exchange had entered into strategic alliances with various stakeholders in the agricultural space to drive insurance with that sector of the economy.

He was optimistic that in the couple of months, revenues would start flowing in from the new line of business.

Odogwu said Royal Exchange Plc will in the years to come, continue to be an aggressive player in the retail market in Nigeria and will be looking at different strategies to increase its product offering and visibility in the marketplace, while not losing track of the corporate market, where the returns and margins, are getting thinner, yearly.

The chairman noted that streamlining major components of the group’s businesses is a continuous exercise especially in the areas of service delivery, processes and operations to deliver superior returns in the medium term to shareholders through digital transformation.

“The group has recently acquired a new insurance software and this will go a long way to enhance our operations and enable the group provide fast and efficient services to our customers.

“This will further enhance our on-going transformation processing involving the revamping of our mobile banking app for our microfinance bank, internet banking and USSD banking, procurement of a USSD code for the sale of all our subsidiaries’ products, ongoing development of a new website with call-to-action/sales capabilities, deployment of a core solution for our healthcare business, among other activities, all geared towards ensuring we remain the leading insurer that we are known for,” the Royal Exchange boss said.

You may be interested

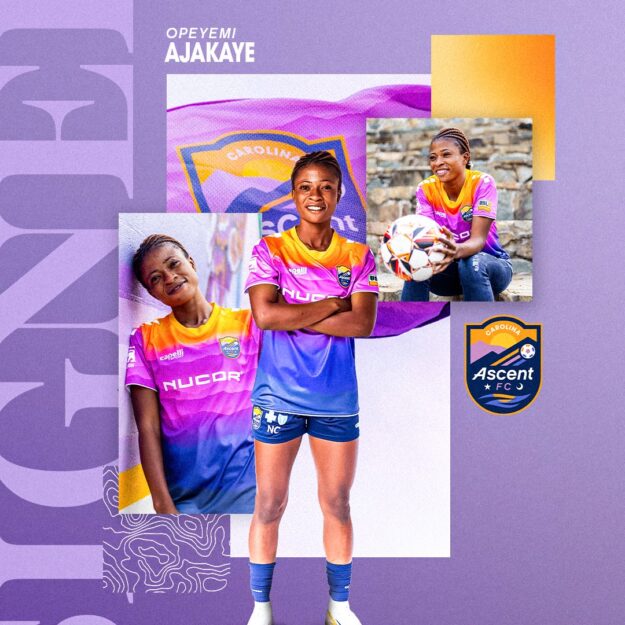

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

Ghana Miss Out On AFCON 2025 Qualification After Draw With Angola

Webby - November 15, 2024Black Stars of Ghana’s hopes of qualifying for next year’s AFCON was ended after they played a 1-1 draw away…

![VeryDarkMan Accuses Reno Omokri Of Allegedly Suppressing Brother’s Rαpe Case [Video]](https://onlinenigeria.com/wp-content/uploads/2024/04/verydarkman-accuses-reno-omokri-of-allegedly-suppressing-brothers-rceb1pe-case-video-300x157.jpg)

![Confusion As May D And Uche Maduagwu Engage In Physical Fight Publicly [Video]](https://onlinenigeria.com/wp-content/uploads/2024/04/confusion-as-may-d-and-uche-maduagwu-engage-in-physical-fight-publicly-video-300x150.jpg)

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)