The Development Bank of Nigeria, says it’s poised to not only be change drivers but be a strong ally partnering with participating financing institutions to drive sustainable development by ensuring that lending is done with the interest of the environment and social wellbeing of the people.

DBN reiterated this commitment at the just concluded capacity-building programme on Environmental & Social Risk Management practice for top executives of Microfinance Banks organized by the bank in Lagos.

Giving his opening remarks, the Managing Director, Development Bank of Nigeria, Tony Okpanachi represented by the Chief Operating Officer, Bonaventure Okhaimo, stated that this workshop was a follow up on the feedback received at an earlier training organized in 2018 for middle level managers of MFBs by DBN.

He charged participants as the leaders of their institutions, to take advantage of the lessons from these workshops to ensure improved compliance as well as best practice in environmental and social risk management principles.

The session highlighted strategies on identification, measurement, and mitigation of Environmental and Social Risks in project financing, from policy and strategic point of view. It also exposed participants to measures of developing Environmental & Social Risk footprints in areas of resource efficiency, reducing carbon emission and other sustainable banking initiatives.

Participants comprising of CEOs and top executives of leading Microfinance Banks in Nigeria expressed their gratitude to DBN for granting them the opportunity to be part of this timely initiative that is designed to upscale MFBs in operationalizing the requirements of Nigerian Sustainable Banking Principles (NSBP).

They also pledged that they will inculcate in their various organizations the strategies and concepts to influence policies and changes that would not only encourage a renewed level of compliance with NSBP but also promote strong corporate governance and responsible banking practices.

The Development Bank of Nigeria has so far on-boarded 27 participating financial institutions and disbursed over N100,000 billion to more than 95,000 MSMEs in Nigeria since the commencement of its operations in 2017

PV: 0

You may be interested

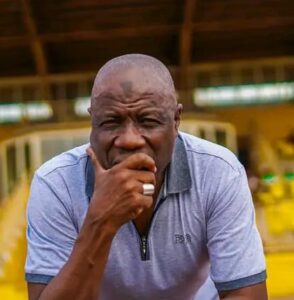

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

2026 WCQ: Osimhen’s Goal Not Enough As Zimbabwe Hold Super Eagles In Uyo

Webby - March 25, 2025The Super Eagles of Nigeria were held to a 1-1 draw by Zimbabwe in their 2026 FIFA World Cup qualifying…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

![Burnaboy Caressing His New UK Girlfriend [VIDEO]](https://onlinenigeria.com/wp-content/uploads/2019/03/burnaboy-caressing-his-new-uk-girlfriend-video-150x150.jpg)

Leave a Comment