Panicky investors yesterday dumped Oando’s shares at the equities market as the embattled indigenous oil and gas group secured a court order restraining the Securities and Exchange Commission (SEC) from removing its top management executives and directors.

Oando’s share price declined by 9.52 per cent, few points below the maximum daily allowable price change at the Nigerian Stock Exchange (NSE).

The company’s share price dropped by 40 kobo to close at N3.80, its lowest price this year. It used to be the third most active stock with a turnover of 27.15 million shares valued at N103.7 million.

Sources told The Nation that the board and management of the company remain unchanged and Mr. Wale Tinubu and Mr Omamofe Boyo remain as Group Chief Executive Officer and Deputy Group Chief Executive Officer.

One of the sources said the planned annual general meeting of the company will hold as scheduled on June 11, adding that the company continues to enjoy the confidence of its critical stakeholders.

SEC had at the weekend released a damning statement on the management and board of Oando, accusing the managers of sundry corporate governance abuses and infractions of capital market laws.

The regulator barred the Group Chief Executive Officer (GCEO) and the Deputy Group Chief Executive Officer (DGCEO) of Oando from being directors of public companies for five years. SEC also ordered certain members of the board of directors to resign.

The apex capital market regulator stated that it had concluded investigation into alleged corporate governance abuses at Oando and found that the company was guilty of serious infractions and market abuses.

SEC also directed the payment of monetary penalties by the company and affected individuals and directors, and refund of improperly disbursed remuneration by the affected board members to the company.

It also directed the convening of an extra-ordinary general meeting on or before July 1 to appoint new directors.

These, among others, the SEC stated, are part of measures to address identified violations in the company.

According to the SEC, following the receipt of two petitions by the Commission in 2017, investigations were conducted into the activities of Oando. Certain infractions were observed. The Commission further engaged Deloitte & Touche to conduct a Forensic Audit of the activities of Oando.

Read also: Oando saga: Why SEC sent Tinubu packing

It said: “The general public is hereby notified of the conclusion of the investigations of Oando Plc. The findings from the report revealed serious infractions such as false disclosures, market abuses, misstatements in financial statements, internal control failures, and corporate governance lapses stemming from poor board oversight, irregular approval of directors’ remuneration, unjustified disbursements to directors and management of the company, related party transactions not conducted at arm’s length, amongst others.”

The commission stated that as required under Section 304 of the Investments and Securities Act (ISA) 2007, it would refer all issues with possible criminality to the appropriate criminal prosecuting authorities.

It added that other aspects of the findings would be referred to the Nigerian Stock Exchange (NSE), Federal Inland Revenue Service (FIRS), and the Corporate Affairs Commission (CAC).

At the weekend, SEC named Mr. Mutiu Sunmonu, a former Managing Director of Shell, as head of an interim management team to oversee the affairs of Oando and to conduct an extra ordinary general meeting on or before July 1 to appoint new directors to the board of the company, who would subsequently select a management team for Oando.

Oando, however, described the SEC’s directives as a calculated attempt to prejudice the business of the company.

In a statement signed by the Company Secretary, Ayotola Jagun and Head of Corporate Communications, Alero Balogun, the company stated that the alleged infractions and penalties were unsubstantiated, ultra vires, invalid and calculated to prejudice its business.

According to the company, it has not been given the opportunity to see, review and respond to the forensic audit report and so unable to ascertain what findings were made in relation to the alleged infractions and defend itself before the SEC.

“The company reserves its rights to take all legal steps to protect its business and assets whilst remaining committed to act in the best interests of all its shareholders,” Oando stated.

You may be interested

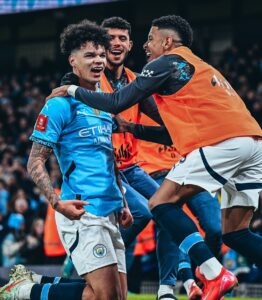

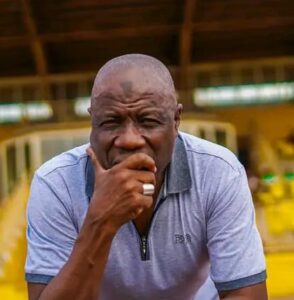

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

2026 WCQ: Osimhen’s Goal Not Enough As Zimbabwe Hold Super Eagles In Uyo

Webby - March 25, 2025The Super Eagles of Nigeria were held to a 1-1 draw by Zimbabwe in their 2026 FIFA World Cup qualifying…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)