Use a clear jar to save

The piggy bank is a great idea, but it does not give kids a visual. When you use a clear jar, they see the money growing. Yesterday, they had a N50 note; Today, they have a N100! Talk through this with them and make a big deal about it growing!

Set an example

A study found that money habits in children are formed by the time they are seven years old. Little eyes are watching you. If you are slapping down plastic every time you go out to dinner or the grocery store, they would eventually notice. Or if you and your spouse are arguing about money, they would notice that too. Set a healthy example for them and they would be much more likely to follow it when they get older.

Show them that stuff costs money

You have got to do more than just say, “That pack of toy cars costs N5,000 son.” Help them grab a few nairas out of their jar, take it with them to the store, and physically hand the money to the cashier. This simple action will have more impact than a five-minute lecture.

Show opportunity cost

That is just another way of saying, “If you buy this video game, then you won’t have the money to buy that pair of shoes.” At this age, your kids should be able to weigh decisions and understand the possible outcomes.

Give commissions, not allowances

Don’t just give your kids money for breathing. Pay them commissions based on chores they do around the house like taking out the trash, cleaning their room, or mowing the grass.

Avoid impulse buys

“Mom, I just found this cute dress. It’s perfect and I love it! Can we buy it please?” Does this sound familiar? This age group really knows how to capitalise on the impulse buy—especially when it uses someone else’s money.

Instead of giving in, let your child know they can use their hard-earned commission to pay for it. But encourage your child to wait at least a day before they purchase anything over N1,500. It will likely still be there tomorrow, and they would be able to make that money decision with a level head the next day.

Stress the importance of giving

Once they start making a little money, be sure you teach them about giving. They can pick a church, charity or even someone they know who needs a little help. Eventually, they will see how giving does not just affect the people they give to, but the giver as well.

Your teen probably spends a good chunk of their time staring at a screen as they scroll through social media. And every second they are online, they are seeing the highlight reel of their friends, family and even total strangers! It is the quickest way to bring on the comparison trap.

Give them the responsibility of a bank account

By the time your kid is a teenager, you should be able to set them up with a simple bank account if you have been doing some of the above along the way. This takes money management to the next level, and will (hopefully) prepare them for managing a much heftier account when they get older.

Get them saving for college

There is no time like the present to have your teen start saving for college. Do they plan on working a summer job? Perfect! Take a portion of that (or more) and toss it in a college savings account. Your teen will feel like they have skin in the game as they contribute toward their education.

Teach them to steer clear of student loans

Before your teen ever applies to college, you need to sit down and have the talk—the “how are we going to pay for college” talk. Let your teen know that student loans aren’t an option to fund their education. Talk through all the alternatives out there, like going to community college, going to an in-state university, working part-time while in school, and applying for scholarships now.

Teach them the danger of credit cards

As soon as your kid turns 18, they will get hounded by credit card offers—especially once they are in college. If you haven’t taught them why debt is a bad idea, they’ll become yet another credit card victim. Remember, it’s up to you to determine the right time you’ll teach them these principles.

Get them on a simple budget

Since your teen is glued to their mobile device anyway, get them active on our simple budgeting app. Now is the time to get your teen in the habit of budgeting their income—no matter how small It is. They should learn the importance of making a plan for their money while they’re still under your roof.

Introduce them to the magic of compound interest

We know what you’re thinking. You can barely get your teen to brush their hair—how in the world are they supposed to become investment savvy? The earlier your teen can get started investing, the better. Compound interest is a magical thing! Introduce your teen to it at an early age, and they’ll get a head start on preparing for their future.

Help them figure out how to make money

When you think about it, teenagers have plenty of free time—fall break, summer break, winter break, spring break. If your teen wants some money (and what teen doesn’t?), then help them find a job. Better yet, help them become an entrepreneur! These days, it’s easier than ever for your teen to start up their own business and turn a profit.

You may be interested

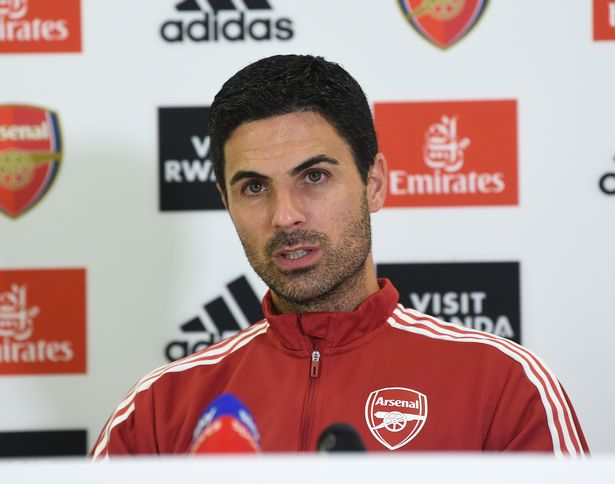

Arsenal Equal Chelsea’s London Derby Feat After 5-1 Win Vs Palace

Webby - December 21, 2024Arsenal equaled Chelsea’s London derby achievement following their 5-1 win against Crystal Palace in Saturday’s Premier League game at Selhurst…

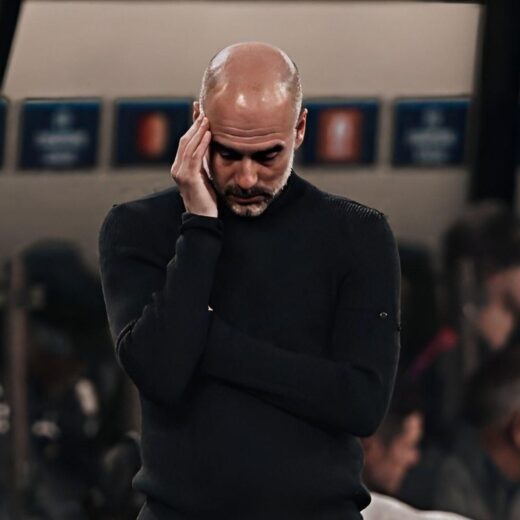

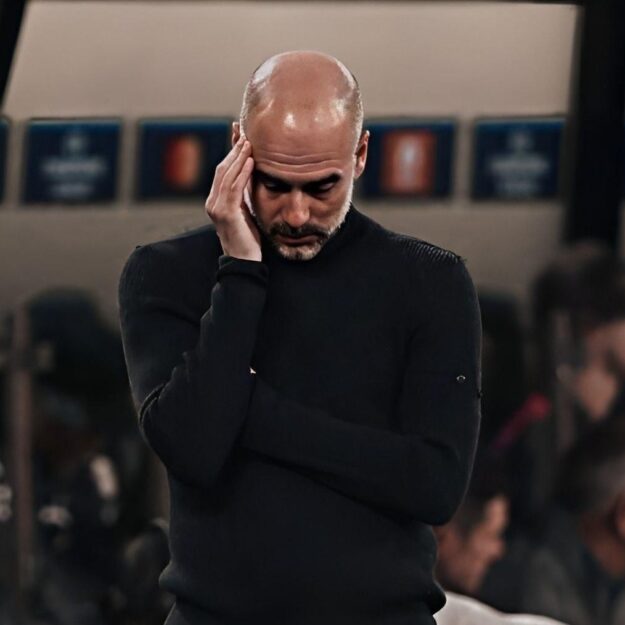

Haaland Backs Guardiola To Turn Man City’s Poor Form Around

Webby - December 21, 2024Erling Haaland had said he and his Manchester City teammates are still backing manager Pep Guardiola to turn the team’s…

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)