The Asset Management Corporation of Nigeria (AMCON) says over Asset Management Partners (AMPs), who are not able to recover debts from 6,000 accounts valued at over N740 billion may be disengaged.

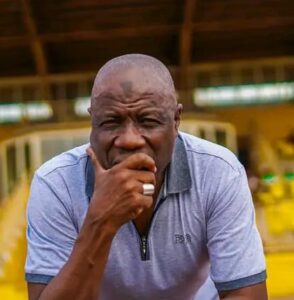

The managing director of the corporation, Ahmed Kuru, said AMPs that have the aggression and zeal to cope with the speed and enormous challenges associated with debt recovery may be assigned more accounts.

“We know the jobs we have assigned to you is not easy. Recovery is a difficult job. But even at that, a few of you (AMPs) have shown they cannot cope. We may have no choice than to disengage such partners.

“But those that have done well, we will upgrade and even assign more responsibilities to such partners. There is indeed need for speed in this assignment.

“We are convinced the AMP programme is key to the success of AMCON, and we will give you all the necessary support to make you succeed in this exercise,” the AMCON boss said.

Mr Kuru issued the threat at the 2019 AMCON/AMPs Interactive/Feedback Session in Abuja.

AMPs are consortia appointed by AMCON with specialist skills to recover and resolve debt issues, and carry out banking, legal, valuation and accounting services.

Mr Kuru said the AMPs were recruited in 2016 as part of the corporation’s renewed strategy to resolve and recover total debt portfolios of over 12,000 loans of various sizes from different sectors of the economy.

He said these debts have lingered for many years after the corporation was established.

Considering AMCON’s limited staff strength, Mr Kuru said it became necessary for the corporation to adopt a strategic approach to improve coverage, recovery and results.

He said the AMPs were appointed to handle over 6,000 accounts within the AMCON portfolio.

The outsourced accounts to the AMPs, in terms of weight, constitute about 20% percent, or N740billion, of the total eligible bank assets (EBA) portfolio of N3.7 trillion.

The AMPs main assignment was to help trace, identify and locate of obligors and their assets (pledged and unpledged), to resolve their outstanding indebtedness, enhance the EBA value, and achieve set recovery objectives.

The AMPs were also empowered to be involved in negotiation of settlement & restructuring of terms with identified obligors in line with approved guidelines; pursue & enforce debt recovery and collection activities.

Where necessary, they were mandated to initiate legal actions to further the loan recovery mandates in line with approved guidelines.

With AMCON winding down its operations, Mr Kuru said more aggression is required with its recovery strategy.

This, he said, required partners to equally step up their game as the corporation can no longer accommodate any AMP not moving on the same speed.

Principal Partner, Lexavir Partners, Francis Chuka Agbu, a senior advocate of Nigeria and AMCON’s Group Head, Enforcements, Aliyu Kalgo also called on the AMPs to leverage the special powers as provided by the AMCON Act 2010 as amended to improve on their assignment.

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)