The Nigerian Stock Exchange (NSE) has amended the rules on Pricing Methodology and price movements of equity securities traded on The Exchange.

The amendments, which take effect on Friday, are to Rules 15:29.2. C.2 of the Rulebook of the Exchange, 2015 (Dealing Members’ Rules). The amendments relate to the minimum trade quantity required to change prices for equity securities traded on The Exchange.

With the development, the minimum trade quantity required to change prices for equity securities traded on The Exchange will henceforth be one hundred thousand (100,000) units for all securities groups.

This implies that trades of fewer than One Hundred Thousand (100,000) shares in any of the groups are small trades. Small trades in equity security will not result in a change in the publicly reported price of such security.

The revised pricing methodology is expected to ensure overall market stability and efficiency and fairness in pricing NSE securities.

The Exchange implemented amendments to its pricing methodology and par value rules that saw the categorisation of quoted companies under three groups with different pricing rules on January 29, 2018.

Group A consists of large-cap equities that are priced at N100 per share or above for at least four of the last six trading months, or new security listings that are priced at N100 or above at the time of listing on the Exchange.

The second category, Group B, consists of medium-priced equities that are priced at N5 per share or above but less than N100 per share for at least four of the last six months, or new security listings that are priced at N5 per share or above but less than N100 per share at the time of listing on the Exchange.

The third category, Group C, consists of equities that are priced at one kobo per share or above but below N5 per share for at least four of the last six months, or new security listings that are priced at one kobo per share or above but below N5 per share at the time of listing on the Exchange.

Previously, the prices of securities would only change if the volume of trade was at a threshold of 10,000 for securities in Group A, 50,000 for securities in Group B and 100,000 for securities in Group C.

PV: 0

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

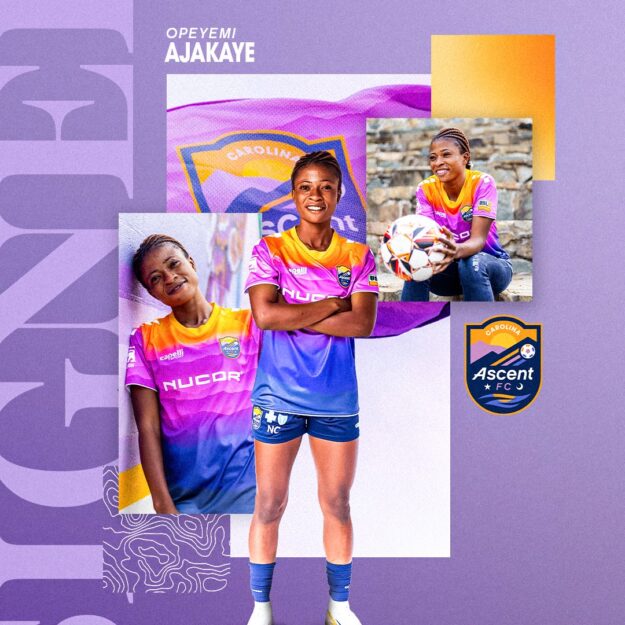

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)