The Central Bank of Nigeria (CBN), on Tuesday, urged the judiciary to lend a helping hand towards ensuring that bank debtors pay back what they owe.

The CBN Governor, Godwin Emefiele, while warning that the era of arm chair banking was over, said the banks must be major players in growing the economy.

He maintained that the days of non-performing loans (NPLs) had become history in the country “as anyone who benefits from any facility must pay back”.

The CBN Governor who was represented by the Deputy Governor, Economic Policy, Dr. Joseph Nnanna, spoke at the 12th Annual Banking and Finance Conference, in Abuja on Tuesday.

His words: “We do not want the banks to be money changers. Banking is not banking if you only play in the government fixed income space.

“Banking becomes meaningful when you take liquidity excesses from your surplus centres and channel them into scarce areas, that way you are transforming liquidity into assets and you are growing the economy and creating employment.”

The era when banks deployed their assets in fixed income instruments particularly Treasury Bills (TBs) and Bonds at the expense of the real sector “is over”.

He however, charged the banking sector not to relent in their efforts to meet up with their responsibility of stimulating the economy.

Emefiele said: “Today, with our new generation banks, the players of this space are digital in nature. We have gone beyond armchair banking where players play safe. Today, the CBN is calling on the banking system to be alive to its responsibility. We cannot conceive an economy without banks and neither can we conceive banks without an economy.

“In the past months, we have come with new initiatives. The loans to deposit ratio is aimed at transforming liquidity management into risk asset management and asset transformation.”

Expressing concern about unemployment, Emefiele urged the banks to play a crucial role by supporting government in asset creation.

“We must support the government in creating jobs for the teeming population,” he said.

He implored banks to redirect their idle liquidity by transforming them into asset creation tools.

“We have also tried to de-risk the banking industry. The days of non-performing loans are behind us and we call upon the judiciary to assist us in this regard,” Emefiele said.

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

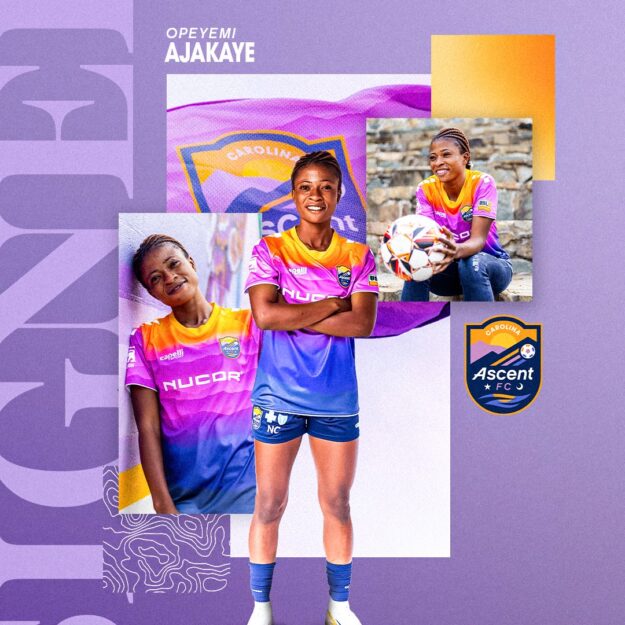

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)