Norfund, the Norwegian Investment Fund for Developing Countries, has invested in Sundry Foods, a Nigerian foodservice supplier operating in the quick service restaurant (QSR), bakery and catering services sectors in its home market.

Financial details have not been disclosed.

Headquartered in Port Harcourt and with regional offices in Lagos and Abuja, Sundry Foods’ brands include Kilimanjaro, Pizza Jungle, Kilishawarma, Nibbles and Suncrust.

Sundry Foods said that with Norfund’s backing it plans to increase its footprint in underserved regions and expand its product offering.

It further plans to increase its current employment base of more than 1,600 staff.

Ebele Enunwa, founder and CEO of Sundry Foods, said: “This investment by Norfund is a testament to the hard work we have put into building Sundry Foods into a formidable business in Nigeria’s food services industry over the last 15 years.

“We like to think of it as an endorsement that we have done something right. With Norfund and our other investors, we are better equipped to pursue the next phase of our growth story. We will be working together to build Nigeria’s premier food company based on the highest levels of systems, food standards and business ethics.”

Norfund, a private-equity fund owned by Norway’s government, said it expects to add value to Sundry Foods by supporting the company’s expansion plans and its ongoing work on achieving global standards, and by contributing increased expertise and focus on the environmental, social and governance fronts.

Naana Winful Fynn, regional director for West Africa for Norfund, said: “We are excited to partner with Sundry’s leadership team, its board and its investors, including Silk Invest. We will work with these stakeholders as an active owner and contribute to creating the premier food company in Nigeria, which will continue to offer nutritious, healthily-prepared local and contemporary food to its customers, to attain the company’s growth and expansion ambitions and to create jobs for many Nigerians during that journey.”

Silk Invest African Food Fund, a Luxembourg-domiciled private-equity fund managed by UK-headquartered Silk Invest, which invested in Sundry in 2012, will partially exit the business through this investment.

Silk Invest said it remains committed to Sundry Foods and will continue to co-manage a minority stake in the firm.

Zin Bekkali, CEO of Silk Invest, said: “Sundry Foods was from day one a great fit with our objective to support authentic African consumer brands backed by committed entrepreneurs. Its leadership team has over the years consistently delivered, and we hope to continue contributing to its growth journey together with Norfund.”

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

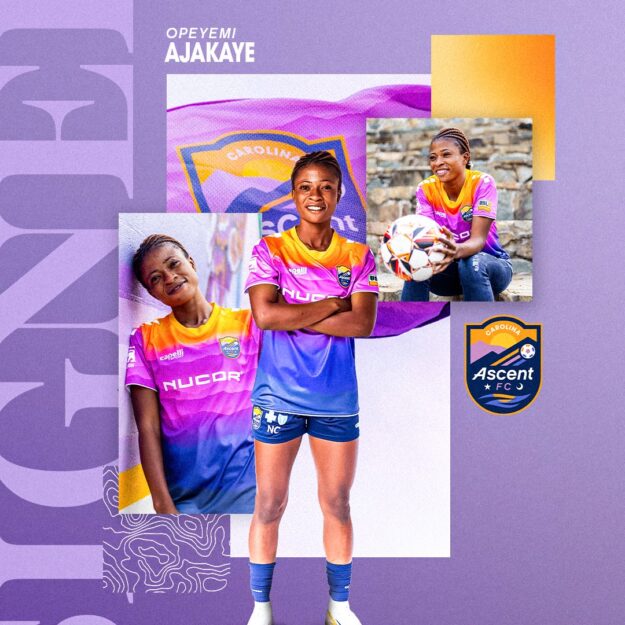

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)