Oil surged to a four-week high as the White House issued a warning to Iran and US crude stockpiles fell.

Brent breached $66 per barrel at 9am UAE time following heated exchanges between US President Donald Trump and Iranian counterpart Hassan Rouhani.

In a series of tweets, Mr Trump said the US had “the most powerful military force in the world” and an attack “on anything American” would be met “with overwhelming force”.

The geopolitical risk of a regional crisis, particularly endangering American assets or lives would push prices up by $10, according to Citigroup.

Oil reversed a bearish start to the month, when high US inventory and stagnant trade talks between Washington and Beijing had sent prices to a three-week low. However, escalating tensions in the Middle East, with the White House poised to target Iran for shooting down one of its drones, rallied the markets. Prices have since climbed, as the US after calling off strikes has been drumming up support against Iran, including imposing sanctions against its Supreme leader Ayatollah Khamenei as well as its Foreign Minister Javad Zarif. Iran said the move had effectively closed the door on diplomacy.

Oil could average $78 per barrel in the near term, Citi said, with prices for the third quarter expected to reach $75 per barrel and $74 per barrel for the fourth quarter.

Continued action by Opec+, scheduled to meet in the first week of July, to correct global supply to the tune of 1.2 million of barrels per day of output is widely expected by the markets in the second half of the year. A meeting between Saudi Crown Prince Mohammed bin Salman and Russian President Vladimir Putin ahead of the Opec+ assembly in Vienna next month is expected to bring reluctant Moscow on board with the cuts.

Meanwhile, Saudi Aramco reassured the markets it has the ability to continue with supplies if the Strait of Hormuz, the chokepoint through which a third of the world’s oil crosses, faces closure.

“We are increasing our readiness,” chief executive Amin Nasser told Bloomberg. “We can supply through the Red Sea and we have the necessary pipelines and terminals.”

Saudi Arabia has a 5 million bpd capacity pipeline linking the kingdom’s oil-rich east with terminals facing the Red Sea in the west. However, pumping stations along this infrastructure came under attack from armed drones in May. Riyadh blamed the Houthi rebels, against whom a Saudi-led coalition is fighting a war in Yemen.

“We had experience through the Gulf conflict but we have always met our commitments to our customers,” Mr Nasser said. “So we have a track record of building enough flexibility in the system to manage a situation or a crisis.”

He spoke in Seoul, where a Saudi delegation accompanied Prince Mohammed for talks with South Korea, one of the top importers of crude from the Middle East. The Saudi prince inaugurated the $4.2-billion expansion of the S-Oil refinery in South Korea on Wednesday.

You may be interested

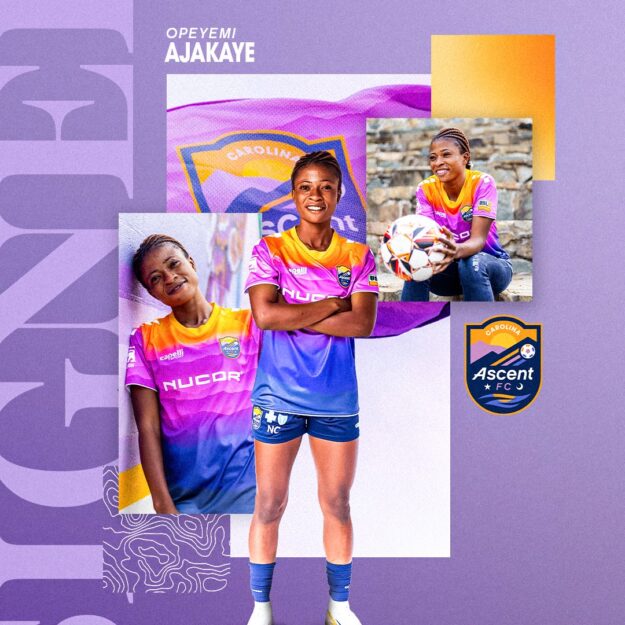

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

Ghana Miss Out On AFCON 2025 Qualification After Draw With Angola

Webby - November 15, 2024Black Stars of Ghana’s hopes of qualifying for next year’s AFCON was ended after they played a 1-1 draw away…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)