Spread the love

By Marcel Okeke

During a radio programme on Saturday, June 17, 2023 (City Talks with Reuben Abati), the guest, a professor of Political Science and International Relations at the Nassarawa State University, Jideofor Adibe, said what has been going on with respect to the Nigerian economy under the new administration were “mere activities”. Adibe who spoke on the ‘State of the Nation: Matters Arising’, said these “activities” were made intense by the speed at which new pronouncements (dished out as ‘new’ policies) were being made on a daily basis. The populace is already swamped, with some of the ‘new’ policies already playing out as counterpoise to some others. But they keep coming in torrents!

Truly, although it took very long for the Nigerian economy to get to the precipice (where it is today), a deluge of ‘policy’ pronouncements cannot turn it around in a jiffy. It will rather cause some disruption. There is no magic wand for economic recovery, growth and development. Rather, the more hurriedly these pronouncements are being made, the more harsh unintended results they unleash on the citizenry. The impression out there is that the new administration is either driven by blind pursuit of vendetta against its perceived enemies or is merely on a mission to ‘impress’ the unwary and gullible public. Every effort in economic management should normally be aimed at improvement of the wellbeing of the citizenry, and not piling up of more pain and hardship on them—as seems to be the case since the inception of the new administration.

A brief review of some of the ‘policy’ pronouncements of the President Bola Ahmed Tinubu administration here will be quite revealing. First, the removal of subsidy on petrol (Premium Motor Spirit, PMS) embedded in the inaugural presidential address on May 29, 2023. The immediate aftermath of the measure was astronomical rise in the price of PMS from below N200/litre to N500—N700/litre, depending on the location. This quickly led to very high cost of transportation, food items, house rents, etc. This also translated to further impoverishment of majority of the citizenry through weakening their purchasing power—and certainly driving up inflation that has attained a galloping level—standing at almost 23 per cent at end-May 2023.

While all these unsavoury outcomes were playing out, rather than addressing the import and impact (or pains) of the fuel subsidy removal, the administration went ahead on further disruption of the economy through more ‘policy’ pronouncements. Thus, till date nobody has put forward definitively, what palliatives the administration is coming up with, to assuage the pangs on the citizenry. Even as the hullabaloo about the US$800 million loan from the World Bank that the outgone Muhammadu Buhari administration was waning, the Tinubu administration is yet to go public with its stand on the controversial loan for palliatives. In point of fact, it is safe to conclude that the government is yet to present any palliatives package to Nigerians, except the hyping of intention to increase salaries of civil and public servants. But what will this amount to—given the minuscule percentage of the population such a measure will affect?

Disturbingly, too, the government is yet to also show genuine effort to address the root cause(s) of the fuel subsidy conundrum nor to deal with the new outrageously high prices of PMS. That is to say that government’s stand on local oil refining is not obvious to the Nigerian populace. The state and fate of the existing four public-owned refineries that have been made moribund for years—hardly seems to be on the agenda of the new administration. Rather, what is widely in the public domain is hustling and intrigues to license more importers of PMS and other products. How long this macabre game will last, nobody knows yet; but real hard times are here!

The issue is no longer the propriety or otherwise of fuel subsidy removal—but rather the concrete measures government must be taking to lessen the suffering and fast-spreading and deepening misery level of the hoi polloi. Given the corruption and opacity that hallmarked the (erstwhile) fuel subsidy regime, its termination is surely good riddance! But the ugly sequels and consequences of the initiative ought not to be allowed to throw Nigerians into more economic hardship—as is playing out currently.

Secondly, and apparently in the spirit of economy disruption, the new administration rushed on—to pronounce merging of exchange rates in the foreign exchange market—or more appropriately, ‘forced’ devaluation (or floating) of the Naira. These have been accompanied with some ancillary measures such as liberalized access to dollars in domiciliary accounts, etc. These ‘policies’ are coming on the heels or backdrop of the huge dust and confusion raked up by fuel subsidy removal and the hard times it unleashed on the people. Desirable as a single exchange rate may be, its direct effect has turned to be outright weakening of the local currency vis-à-vis the dollar and other hard currencies. The ‘forced’ merger of exchange rates obviously translates to Naira devaluation—a trend that could linger interminably!

Nigeria has been notoriously an import-dependent economy and mono-product economy. Crude oil remains its mainstay. A large chunk of its citizens also have been known to have unrepentant preference for foreign goods and services. Conspicuous consumption and aversion to local products by the people have over the years been feature of the Nigerian economy. In this culture or ecosystem, demand for the dollar has always far outstripped the supply in the foreign exchange (forex) market—leading to the continuous weakening of the Naira against the dollar and others.

A well-thought through policy would have come with some sequencing or phased approach—bearing in mind the likely deleterious unintended consequences a ‘wholesale’ rushed method portend. This is why in the current milieu, as the Naira keeps ‘sinking’, economic agents are flying to safety. ‘Seek for, and hold onto the dollar’, appears to be the only modus vivendi—for businesses and individuals alike. On the supply side, government has also gone ahead to remove all incentives that attracted forex inflow via non-oil exports in recent times. This is in sync with its economy disruption efforts.

Unfortunately, while the Tinubu administration is making all these ‘policy’ pronouncements, the initiatives are not ‘owned’ by those saddled with their implementation. For instance, merger of multiple forex rates and others are not ‘strictly’ coming from the Central Bank of Nigeria (CBN). The new ‘policies’ are ‘order from above’ and rammed down the throat of the acting head of the apex bank and his colleagues, who, as it were, are mere puppets in the hands of the powers that be. If not so, the CBN, armed with its usual evidence-based update on the economy, would have opted for slower pace of implementation of these policies or entirely different set of policies.

In all, the whirlwind of ‘policies’ being unleashed by Nigeria’s new administration portends cataclysmic outcomes. They amount to economy disruption rather than genuine reforms. The torrents of ‘activities’ going on would seem to be giving the perception that the administration is only out to impress or ‘wow’ Nigerians—at the expense of their wellbeing and economic progress. It is usually better to ‘make haste slowly’ when it comes to making policies regarding delicate and sensitive issues that have to do with the life, livelihood and survival of the people. This is no time for playing to the gallery!

- Mr. Okeke, a practising Economist, Business Strategist, Sustainability expert and ex-Chief Economist of Zenith Bank Plc, is a National Daily Columnist. He can be reached via: [email protected]

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

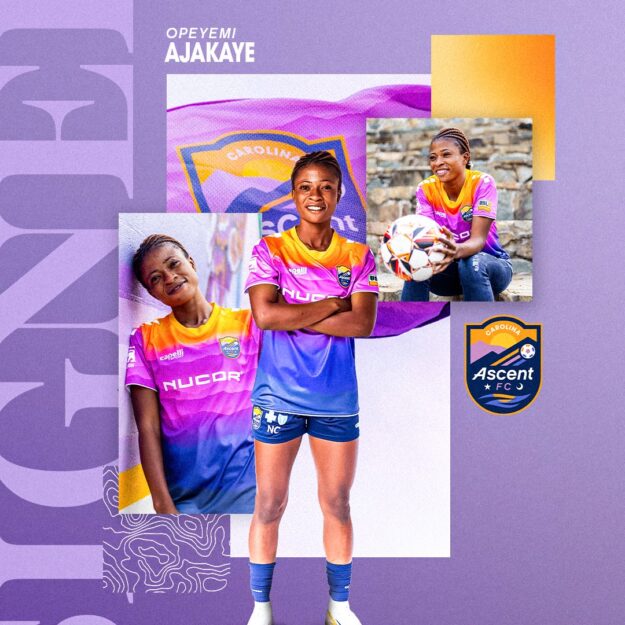

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)