Spread the love

The Debt Management Office (DMO), says Nigeria’s debt is unsustainable, as 73.5% of 2023 revenue will be used to service debt, threatening Nigeria’s capacity to repay its debt adequately.

Nigeria’s total public debt hit N68.9 trillion, according to new figures DMO.

Excluding the CBN loans, which is N22.71 trillion, DMO said Nigeria’s total public debt is N49.85 trillion at the end of the first quarter (Q1) of 2023.

“As at March 31, 2023, the total public debt stock comprising the external and domestic debts of the federal government of Nigeria (FGN), the thirty-six (36) States, and the Federal Capital Territory (FCT) was N49.85 trillion (USD 108.30 billion).

“The public debt stock for March 2023 does not include the FGN’s N22.719 trillion Ways and Means Advances of the Central Bank of Nigeria whose securitization was approved by the National Assembly in May 2023.

DMO said new borrowings will increase Nigeria’s total public debt-to-GDP ratio to 37.1% in 2023, according to projection, nearing the self-imposed debt limit of 40%.

READ ALSO: DMO raises concerns over Nigeria’s rising debt burden

Part of DMO’s recommendation to the government following an analysis of Nigeria’s debt profile in 2022 is an increase in projected Federal Government of Nigeria revenue from N10.49 trillion to about N15.5 trillion, to enable the country strengthen its debt service.

“Although the Baseline analysis projects Total Public Debt-to-GDP ratio at 37.1 percent for 2023 indicating a borrowing space of 2.9 percent (equivalent of about N14.66 trillion) when compared to the self-imposed limit of 40 percent, it is recommended that this should not be used as a basis for higher level of borrowing as was the case in the 2023 Budget.

“This is because the outcome of the Shock Scenario, which is more realistic in the circumstances, exceeded the self-imposed limit,” BNO said.

“The projected FGN Debt Service-to-Revenue ratio at 73.5 percent for 2023 is high and a threat to debt sustainability. It means that the revenue profile cannot support higher levels of borrowing. Attaining a sustainable FGN Debt Service-to-Revenue ratio would require an increase of FGN Revenue from N10.49 trillion projected in 2023 Budget to about N15.5 trillion,” the debt office noted.

It further stated that: “With respect to expansion in fiscal deficit, there is need to strictly adhere to the provision of extant legislations on Government borrowing, especially the Fiscal Responsibility Act 2007 and Central Bank of Nigeria Act, 2007 as it relates to Ways and Means Advances, in order to moderate the growth rate of public debt.”

DMO added: “There is urgent need to pay more attention to revenue generation by implementing far reaching revenue mobilization initiatives and reforms including the Strategic Revenue Growth Initiatives and all its pillars with a view to raising the country’s tax revenue to GDP ratio from about 7 percent (one of the lowest in the world) to that of its peer.”

You may be interested

UCL: Bayern Munich, Real Madrid Battle To Thrilling Draw

Webby - April 30, 2024Bayern Munich and Real Madrid battled to a 2-2 draw in an entertaining Champions League semifinal, first leg on Tuesday.Thomas…

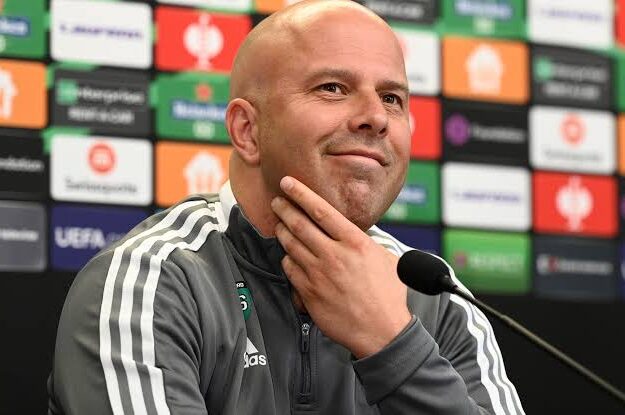

Super Eagles Must Qualify For 2026 World Cup – NFF Tasks Finidi

Webby - April 30, 2024Newly appointed Super Eagles head coach Finidi George has been tasked with the responsibility of ensuring the team’s qualify for…

NFF Settled For Finidi Due To Financial Constraint –Ikpeba

Webby - April 29, 2024Former Nigerian international, Victor Ikpeba has finally disclosed why the Nigeria Football Federation (NFF) settled for Finidi George as the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)