Apex capital market regulator the Securities and Exchange Commission (SEC) has regularized 3.4 billion ordinary shares which hitherto were fictitious.

The Capital Market Committee (CMC) – a consultative assembly of stakeholders in the Nigerian capital market – last November, extended the deadline for investors that used fictitious names and other surreptitious means to buy shares to claim their shares from December 31, 2018 to December 31, 2019.

At the weekend, the CMC announced that 3.4 billion ordinary shares had been regularised under the “Multiple Subscription Initiative (MSI)”.

The MSI is aimed at the regularisation of shares purchased with multiple identities, by investors-otherwise known as ghost shareholders that conjured up many identities to secure large allocation of shares, especially during public offerings.

The 2005-2008 boom period of the capital market had witnessed significant increase in public offerings as several banks, insurance companies and other non-financial quoted and unquoted companies jostle to raise funds through the capital market.

Read Also: FAAC shares N769.523b JULY 2019 revenue to Fed Govt, States and LGAs

Acting Director-General, Securities and Exchange Commission (SEC), Mary Uduk, said that after extensive discussions with the CMC, the Commission intends to partner with the Central Bank of Nigeria (CBN) on the issue of charges on the e-Dividend Mandate Management System (E-DMMS) transactions.

According to her, the CBN has published charges for the banks, this means that any transactions carried out by any bank, there is an established charge. The e-dividend charge is not part of the charges from the CBN and so because of that investors are having issues with banks where for instance they are charged for some transactions that are not listed as bank charges which they do not know.

She said: “They complained to us and so we decided that we will engage CBN to actually make this part of their charges and so any e-dividend carried out will be charged by the CBN. This came up as a result of us stopping the payment of the e-dividend mandate as we were underwriting the initiative before we mandated investors to pay a token of N150 per mandate.”

The director-general further noted that brokers and registrars are required to make available to the Committee on multiple subscription account, on a periodic basis, the number of regularised accounts and added that the commission will continue to engage with relevant stakeholders on e-Dividend and multiple subscription accounts.

Also speaking, Acting Executive Commissioner, SEC’s Corporate Services, Henry Rowland, said more than 3.4 billion shares have been effectively regularised and 2.7 million accounts have been mandated on e-Dividend.

“As we all know the unclaimed dividend issue is a dynamic one, while we were solving the issue, new ones come in. we can confirm that about 2.7 million accounts have been mandated and when you look at that, you go back to think that if each mandated account will attract a number of dividends unclaimed, then it is of essence,” Rowland said.

You may be interested

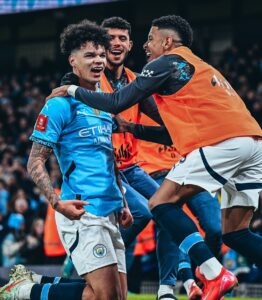

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

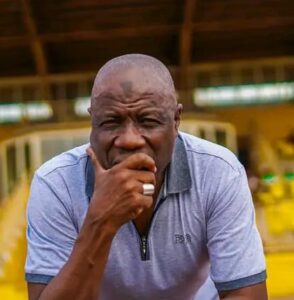

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)