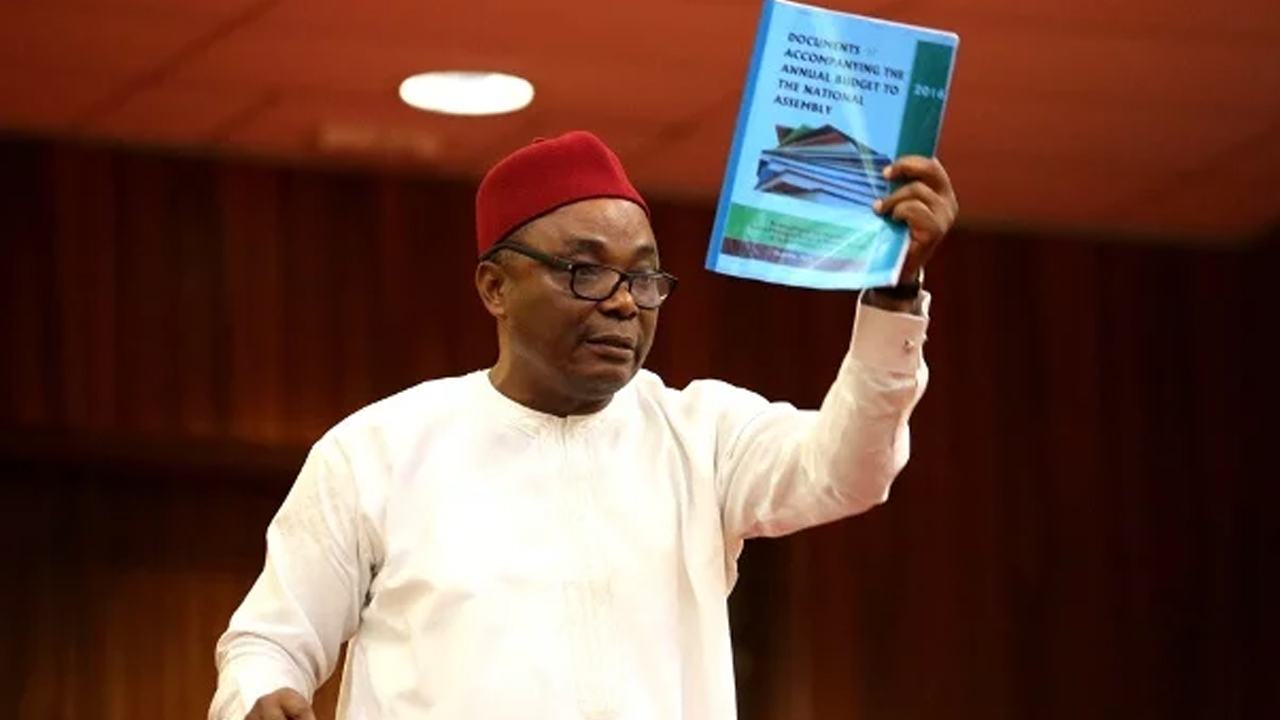

The Supreme Court has quashed the conviction of Senator Peter Nwaoboshi (Delta North) and his sentencing to seven years imprisonment for offences of fraud and money laundering.

The apex court also ordered his immediate release from the Ikoyi prisons in Lagos, where he is currently being held.In a judgment yesterday, the Supreme Court also freed the two companies – Golden Touch Construction Project Ltd and Suiming Electrical Ltd – that were tried with him on a two-count charge preferred against them by the Economic and Financial Crimes Commission (EFCC).

It held that, “the facts of this case, as disclosed by the prosecution, does not support the prosecution of the defendants for fraud and money laundering.”

The judgment was a split decision of four-to-one and the Supreme Court. It set aside the July 1, 2022, judgment of the Court of Appeal, Lagos, which had reversed their discharge and acquittal by a Federal High Court in Lagos.

While Justices John Okoro, Uwani Aba-Aji and Adamu Jauro agreed with the lead judgment, written by Justice Emmanuel Agim, Justice Ibrahim Saulawa dissented.

The EFCC had accused Nwaoboshi and his companies of illegally acquiring a property named Guinea House on Marine Road, in Apapa, Lagos, for N805 million, said to belong to the Delta State government.

The anti-graft agency had claimed that part of the money paid for the property was transferred by Suiming Electrical Ltd on behalf of Nwaoboshi and Golden Touch Construction Project Ltd, adding the funds were believed to be proceeds of their illicit activities.

Justice Agim, in the lead judgment, held that Nwaobishi and the two companies were unjustly and maliciously prosecuted by the EFCC for committing no offences known to law, adding that they were subjected to needless criminal trial in relation to a civil transaction.

He noted that by the facts of the case as presented by the EFCC, Suiming Electrical Ltd got a loan of N1.2 billion from the Nigerian Export Import Bank (NEXIM), from which it was said to have provided N322 million for the purchase of Guinea House.

The judge noted that throughout the trial, the EFCC failed to show that the defendants committed any criminal offence known to law and for which they ought to be so prosecuted.

He held that there was no evidence that the loan was fraudulently obtained, adding that there was no complaint from the NEXIM Bank that the company to which the loan was granted had defaulted.

He added that the NEXIM Bank staff confirmed that the tenure of the loan had not expired for anyone to conclude that the loan beneficiary had defaulted.

Justice Agim held that, even if the loan beneficiary defaulted or diverted the loan for a different purpose outside the reason for which the loan was given, such development could not clothe the EFCC with any power to subject Nwaobishi and his firms to criminal prosecution.

He observed that the claim of the EFCC was that the company got the loan for the purpose of enhancing its operations, but allegedly diverted N322 million out of the loan for the purchase of Guinea House.

The judge said that the development did not amount to fraud and money laundering, in respect of which Nwaobishi and his firms were subjected to criminal prosecution by the EFCC.

Justice Agim held that it was wrong for the EFCC to have prosecuted the company that got the loan, when it has the right to decided what to do with its funds, having lawfully acquired the loan.

He faulted the Court of Appeal for reversing the decision of the trial court and convicting the defendants on allegation that they diverted the loan, which was not part of the offences for which they were tried at the trial court

“The arrest, detention and prosecution of an alleged loan defaulter is illegal. What is worrisome is that the NEXIM Bank never complained that the loan was unlawfully obtained and that there was default in repayment.

“The company, the 3rd respondent, which is the owner of the money or beneficiary of the loan cannot be prosecuted for misappropriating the said money, which it lawfully acquired,” he said. Justice Agim held that the remedy for the breach of any loan agreement, which is a civil agreement, did not lie in criminal prosecution by the EFCC.

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)