Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, yesterday revealed how he battles abuses and insults for adopting unconventional methods in tackling Nigeria’s economic challenges.

He made the revelation while delivering the first Distinguished Leadership Programme Lecture of the School of Economics, University of Ibadan.

Emefiele, who has just been reappointed for a second term of five years by President Mohammadu Buhari, disclosed that insults and abuses are hauled at him at home and abroad by individuals, organisations and representative of countries who are no longer benefitting from the new policies that help reduce importation, grow local industries and farming and ultimately create more jobs for Nigerians.

He added that the efforts also helped reduce pressure on foreign exchange, increase foreign reserve and generally improve the country’s economy.

With the improvement, Emefiele disclosed that the current foreign reserve is able to finance a nine-month import bill.

Speaking on the topic: Up Against the Tide: Nigeria’s Heterodox Monetary Policy and the Breton Woods Consensus, the CBN governor explained that tackling Nigerian multiple economic problems in the face of dwindled crude oil prices, smuggling and dumping of foreign goods requires extraordinary measures which cannot afford to be conventional as may be advised by the Breton Woods institutions.

According to him, the economic recession of 2014 presented a daunting challenge to the apex bank. To exit the economic downturn, Emefiele revealed that the bank was forced to embrace some hard, unconventional methods in the overall interest of the country.

He listed the methods to include raising Monetary Policy Rate from 12 to 14 per cent in order to “rein in expected inflationary pressures that may result from exchange rate,” introduction of demand management approaches to foreign exchange in order to conserve foreign reserve and support domestic production, opening of different foreign exchange windows to take care of the interests of investors, exporters and other critical sector participants as well as introduction of risk-based supervision which include monitoring compliance of supervised institutions and assessment of the risk profile and governance management practices of banks.

One major idea, he said, was the development finance intervention which is the increase of lending to the agriculture and industrial sectors through targeted interventions schemes such as the Anchor Borrowers Programme, Commercial Agricultural Credit Scheme and the Rural Sector Support Facility.

“In particular, we sought to improve domestic supply of four commodities (rice, fish, sugar and wheat) which consume about N1.3 trillion annually in our nation’s import bill,” he said.

He explained that the interventions have yielded results as many more farmers now grow higher quantity of food for local consumption which has largely reduced importation, reduced pressure in foreign exchange, created jobs and empowered more citizens economically.

The CBN governor further explained that the bank did not hand over cash to beneficiaries. Rather, they were given improved seedlings, herbicides, and so on, to prevent diversion of funds.

Similar approaches were adopted for the players in the manufacturing sector.

He further revealed that a sum of N30 billion has been set aside to support the creative industry in Nigeria.

While the interventions were introduced, Emefiele said he was being insulted, abused and criticised by adherents of conventional methods and those who would not benefit from the new innovations which he described as unconventional.

For restricting 41 (now 43) items from access to FOREX, Emefiele said the policy was faulted by critics, but pointed out that the unconventional policies helped Nigeria exit recession and have helped improved the economy at large.

He said: “In the view of some critics, for instance, our FX policies constitute exchange restrictions, rationing of FX, discretionary allocation based on priority categories, and multiple currency practice.

“Many are also unaccepting of our 41 items restriction and its recent increase to 43 items, regardless of its apparent successes.

“While there is sufficient evidence of significant reductions in our annual import bill, increased non-oil output and exports, and a robust BOP position, these critics assert that we are restricting trade and creating unfair competition.

“To our critics, who are against the imposition of the FX restrictions, conventional Monetary Policy requires that to encourage domestic production, we should impose higher tariffs and levies. However, our experience in Nigeria has shown that this practice has never worked due to certain inefficiencies in attaining these objectives”.

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

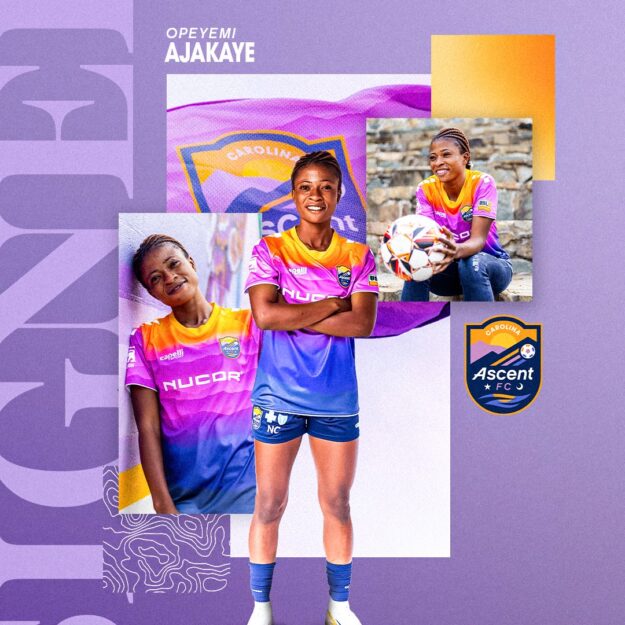

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)