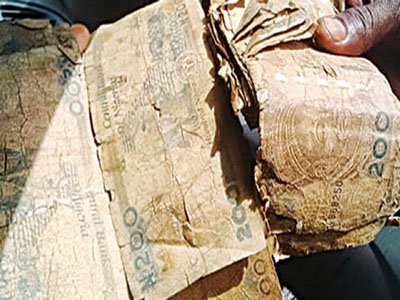

Torn and smelly banknotes have been in the banking system for long. Banks have kept recycling the notes to save sorting costs without considering the implications to the financial system and customers’ businesses. The clean note policy and banknote fitness guidelines unveiled by the Central Bank of Nigeria (CBN) is expected to reverse the trend as nearly N7.9 trillion pieces of unfit notes will be withdrawn from circulation. COLLINS NWEZE examines what it takes to rid the economy of such notes.

EDITH Okafor, a Lagos-based consumer goods distributor, is worried that for the past four years, what she has been paid with were worn-out banknotes from her customers.

Some of the notes are so bad that her customers kept rejecting them as balance after transactions. In some of the occasions, her customers would throw the dirty banknotes back at her, saying they needed cleaner notes.

Whenever Edith tried to reject the banknotes, the feedback from her customers are always the same: “I got this money from my bank or do you think I print money? Where do you want me to get cleaner notes?”

Perhaps, the customers are right. Finding new naira notes is like finding a needle in a haystack despite the fact that a country’s currency is its national pride.

When the local currency is dirty, soiled, mutilated, or even defaced, such abuses impact negatively on the perception of the nation.

For many Nigerians like Edith, the sorry state of the Naira notes in circulation is appalling and a serious source of worry. The Central Bank of Nigeria’s (CBN’s) disclosure that a large proportion of the N7.9 trillion pieces of naira notes in circulation are dirty, mutilated, unfit for Automated Teller Machines (ATMs) and over-the-counter payments has given credence to Edith’s worries.

The worrisome development is already affecting businesses, especially micro, small and medium enterprises (MSMEs) that need the local currency, especially the lower denominations to transact their businesses.

The development has, therefore, prompted the CBN to begin the process of getting the commercial banks and stakeholders in the currency circulation project to implement its clean note policy and banknote fitness guidelines that will involve withdrawal of the dirty notes from circulation.

CBN’s Deputy Governor, Operations, Folashodun Shonubi and Director, Currency Operations Department, Mrs. Pricilla Eleje, spoke of plans to withdraw the dirty notes from circulation at last week’s launch of the policy in Lagos. The officials said the bank had the obligation of providing an adequate supply of clean banknotes to facilitate seamless payment and settlement of transactions by the public, the government and banks.

The CBN described the measure as the first step in its bid to address the disturbing state of the notes in circulation and create a new culture for better handling of the currency.

Mrs Eleje said the clean note policy provides a uniform standard for the circulation of only clean and fit banknotes; while the banknote fitness guidelines provide the industry with clear and acceptable criteria for determining the quality of notes in circulation.

The policy guidelines, she explained, were developed after extensive collaboration and engagements with key industry stakeholders under the auspices of the Nigerian Cash Management Scheme, a Bankers’ Committee initiative.

The plan will ensure that unfit, dirty, mutilated and counterfeit banknotes are not in circulation. This is pursuant to Sections 18, 20 & 21 of the CBN Act 2007, which prohibits the counterfeiting, sale and abuse of the naira.

She said: “The CBN cannot achieve these objectives without the collaboration of Deposit Money Banks (DMBs), merchant banks, microfinance banks, government agencies, cash-in-transit (CIT), cash processing companies (CPCs), market associations, merchants/retailers, chambers of commerce and industry, security agencies, currency management equipment manufacturers , bank customers and the public.”

She explained that over the years, the growth in economic activities and the upsurge in population had necessitated the rise in the volume of banknotes in circulation.

The CBN said: “In view of technological advances, the CBN, like other central banks, has introduced various forms of electronic payment systems for effective and efficient settlement of transactions and to reduce the volume of cash usage with its attendant cost implications.

“Despite the prevalence of other forms of payment, cash remains ‘king’ in our day to day economic transactions. As such, people still prefer to use cash in making payments, especially where there are no digital payment platforms.

“Consequently, demand for cash continues to grow despite technological advances. Thus, the volume of currency in circulation as at the end of 2012 rose significantly by 10.34 per cent to 7,914.70 billion pieces, as at the half-year of 2018. A large proportion of the notes in circulation were dirty, mutilated, not fit for ATMs and over-the-counter payments.

“To overcome the challenge, the CBN increases the supply of clean notes and withdraws the soiled and mutilated notes from circulation.

“In addition, the bank introduces from time to time a number of currency management initiatives to ensure that the production, issuance of new notes, processing by third service providers as well as recirculation by the deposit money banks (DMBs) conform to the predetermined standards.

“To ensure that the banknotes in circulation are clean and of high quality, the bank hereby issues the clean note policy. The clean note policy enunciated, therefore, by the bank, entails a spectrum of diverse currency management activities geared towards the efficient circulation of premium quality banknotes and withdrawal of unfit/soiled banknotes to guarantee public confidence and usage of the naira banknotes as a medium of exchange.

Stakeholders back policy

The Association of Bureaux De Change Operators of Nigeria (ABCON) has given its support to the Clean Note Policy and Banknote Fitness Guidelines.

ABCON President, Aminu Gwadabe, said the launch of the CBN Clean and Banknote Fitness Policy is not only apt but timely because of the high volume of unfit and dirty notes in circulation across the country.

He said the policy will discourage the attitude of the public in stashing naira notes in their homes and farms as witnessed recently.

He said the policy will also increase the level of money supply in the economy, and subsequently deepen the volume and value of credit available to real sector operators and other major segments of the economy.

Gwadabe said the policy entails diverse currency management plans geared towards the efficient circulation of premium quality banknotes and withdrawal of unfit/soiled banknotes. This, he said, will guarantee public confidence and usage of the naira banknotes as a medium of exchange.

According to Gwadabe, the move by the apex bank to sanitise the estimated N7.9 trillion pieces in circulation will enhance transparent currency management system, promote financial inclusion and enhance the confidence of the informal sector in the financial system.

The ABCON boss said the CBN has through the new policy plans, demonstrated its commitment to seamless payment system adding that the regulator has the obligation of providing an adequate supply of clean banknotes to facilitate efficient payment and settlement of transactions by the public, government and banks.

He said the policy guidelines are backed by the Sections 18, 20 & 21 of the CBN Act 2007 which prohibits the counterfeiting, sale and abuse of the naira.

Gwadabe said ABCON, and its over 4,500 members will collaborate with the CBN to make the new policy a success. He said that Nigeria remains a cash-based economy and that the new policy is crucial to ensure that the local currency remains attractive to the people.

The ABCON boss said despite the use of e-payment channels, majority of Nigerians still use cash in their day-to-day economic transactions, especially in making payments especially where there are no digital payment platforms.

He said the BDCs have remained resolute in ensuring sustainable and stable exchange rate, price discovery and uniformity in the market pricing for the dollar against the naira.

He said the CBN-licenced BDCs under the aegis of ABCON is not in business solely to make a profit but to protect the local currency and ensure that the economy thrives through its contribution to job creation and improved dollar liquidity in the economy.

Policy implementation

To ensure that the policy succeeds, Eleje asked bank customers to report any commercial bank that rejects dirty, soiled, worn out, defaced or mutilated naira notes for sanction.

She said the apex bank will soon circulate the guidelines on clean note policy to banks, which will also be made available to bank customers for them to know when any lender is not complying.

Eleje said the regulator will regularly carry out spot checks on bank branches, based on complaints from customers, which will serve as a guide on where to go.

“Complaints from customers on any bank not accepting dirty notes will serve as a trigger for the CBN to know where to go and the penalty for defaulting banks. There should also be a banner in every banking hall for customers to understand the Note Policy and Banknote Fitness Guidelines and also their rights as stipulated in it,” she said.

The CBN Director, also said the apex bank is planning mobile courts to try currency counterfeiters to serve as a deterrent to others.

She said the CBN will continue to sensitise the public on the basic security features of the notes, the dangers of sale of the Naira, and proper handling habits of the banknotes by the public. She said that any abuse of the Naira is a criminal offence, punishable under the CBN Act of 2007.

In his keynote address, CBN Governor, Godwin Emefiele, said currency management is vital to people’s daily lives because, despite the improvements in the electronic payments system, banknotes remain predominant for payment and settlement of commercial transactions in Nigeria.

“The effective use of these documents by relevant stakeholders would ensure that banknotes in circulation are clean and of high quality. Characteristics that are key to sustaining public confidence in the national currency,” Emefiele said in an emailed statement.

He added: “The CBN has registered eight companies to carry out cash-in-transit and two cash processing companies to operate in Nigeria. Deposit money banks (DMBs) are expected to patronise only these registered companies for Cash-in-Transit and sorting services. It is expected therefore that more private sector participation in the currency management value chain would further strengthen the efforts toward ensuring availability of clean banknotes”.

He said the CBN has also put in place strategies to enable direct disbursement of lower banknotes to various market associations and merchants through their respective DMBs adding that the intervention commenced in Abuja and has been extended to Lagos, Kano, Enugu, Umuahia, Yola, Jos, Gombe, Asaba, Ibadan, Kastina, Uyo, Minna and Port Harcourt.

Also, the apex bank has reduced the processing charges for DMB deposit of lower denomination banknotes N5 to N50 to encourage the return of unsorted banknotes to CBN for processing.

“The bank also intends to embark on a project that would enable mop-up of the over-circulated and mutilated banknotes from circulation. Furthermore, the CBN would continue to embark on sustainable institutional reforms and enact policies that will promote efficient currency management in Nigeria,” Emefiele said.

He urged Nigerians to handle the Naira banknotes properly; as it is a criminal offence to abuse the Naira adding that the local currency is Nigeria’s identity as a country and needed to be respected.

He said it would affect commerce because people would be more inclined to spend where there are new notes in their hands. We believe it will definitely help the economy and it will complement the cash-less economy.

He said the CBN has put in place measures to ensure that banks circulating unfit notes are sanctioned. “The majority of the notes that are new, are processed notes. We are hoping that the private sector will help in sorting out the notes, to ensure that only fit notes are circulated. In an ideal situation, it is only the unfit notes and counterfeit notes that should come to the CBN for replacement. That’s the part we would want the private sector to help us in achieving desired results,” he said.

Classifying mutilated notes

Eleje described a mutilated banknote as a poor quality banknote that requires a special examination to determine its value. The note could be partially or permanently damaged by fire, water, dye, insects, rodents or destroyed by natural disasters.

The new policy, she added, was in a bid to enhance the availability of clean notes and effect expeditious withdrawal of dirty notes from circulation.

The apex bank said Deposit Money Banks and Cash Processing Companies (CPCs) making deposits at the CBN should classify their cash deposits into fit and unfit notes.

The CBN said the unfit notes should be sorted, classifying mutilated notes differently.

“An unfit banknote refers to a genuine banknote that is no longer fit for circulation in accordance with the quality standard set by the CBN. A banknote would be considered unfit for recirculation if it was badly soiled or if there was a general distribution/localisation of dirt. Other features that could make a note be classified as unfit were if the note presented a limp/rag appearance due to excessive folding that resulted in the breakdown of the texture and structure of the note or if the note had added image or lettering marked on it or it had a hole that was more than 10 mm,” the regulator said.

Continuing, it added: “Other features that classify notes as unfit are torn parts of the banknote that are re-joined with adhesive tape in a manner that tries to preserve as nearly as possible the original design and size of the note; reduction in the original size of the note through wear and tear or fire, rodents and chemicals; perforation of the notes; and loss of more than half of the original size of the banknote.

“Unfit banknotes shall not be re-circulated by DMBs and CPCs. However, a penal charge of N12,000 per box or any amount determined by the management of the CBN shall apply for the deposit of unsorted banknotes.

“In addition, penalties, as may be determined by the CBN, shall apply for the re-circulation of unfit banknotes.”

The CBN said offenders would be liable to a fine of N50,000 or six months imprisonment or both under the provision of Section 21 of the CBN Act, 2007.

It said the writing or graffiti paintings, mutilation, stapling, tearing or making a hole of any kind, spraying, soiling and matching are highly offensive and punishable.

The CBN said it would ensure that the Automated Teller Machines deployed by DMBs and other service providers were configured to dispense and accept only genuine banknotes in all denominations.

It added that the ATMs would only dispense notes that had been duly checked for authenticity and fitness according to the CBN’s standard and operators whose ATMs contravene this provision shall be sanctioned in line with the existing guideline.

“The CBN and DMB shall continue to receive mutilated notes from the public. The procedures for the treatment of mutilated notes and the notes for exchange are as enshrined in the Central Bank Operational Manual for the Operation of Mutilated Notes,” it said.

Bankers’ Committee to

sanction naira abusers

Those who “spray” naira notes at parties risk going to jail, the Bankers Committee has also warned.

Mobile courts are to try those bastardising the national currency, it said.

Issuing the warning after its meeting in Lagos, the Bankers Committee said the mobile courts would be deployed nationwide to try those mishandling the currency.

Speaking on the development, CBN Director, Corporate communications, Isaac Okorafor said the Police and the Ministry of Justice would be involved in the operation, adding: “If a celebrant is dancing and you spray him/her, you may go to jail from the party venue because the law enforcement agents will be there, waiting to arrest you.

“It is the duty of law enforcement agencies to catch offenders and take them to court. Our collaboration with the police will intensify as we move to implement the mobile court for offenders.”

Admonishing Nigerians on how to use cash as a gift, Okorafor said: “If you want to give, put the money in an envelope, and give it the celebrant. Let’s know that anybody hawking and writing on the naira will face six months in jail or N50,000 or both.”

Managing Director of First Securities Discount House (FSDH) Merchant Bank Mrs Handa Ambah said people selling naira notes would be punished.

She said: “We need to let them know that this is money. The fact that you cannot spray money at parties does not mean that you cannot put money in an envelope and pass it to the celebrants.”

Other financial pundits insist that getting the clean note policy working would require banks and other stakeholders to ensure notes in circulation are clean and of good quality.

The banks, they added, are also expected to classify notes into a fit and unfit category and return unfit ones to the CBN. The lenders are to equally ensure the adequacy and availability of currency banknotes in the right denominational mix to meet public demand and maintain confidence in the local currency.

Only then will the dirty smelly banknotes circulating across the country and killing businesses will be a thing of the past.

You may be interested

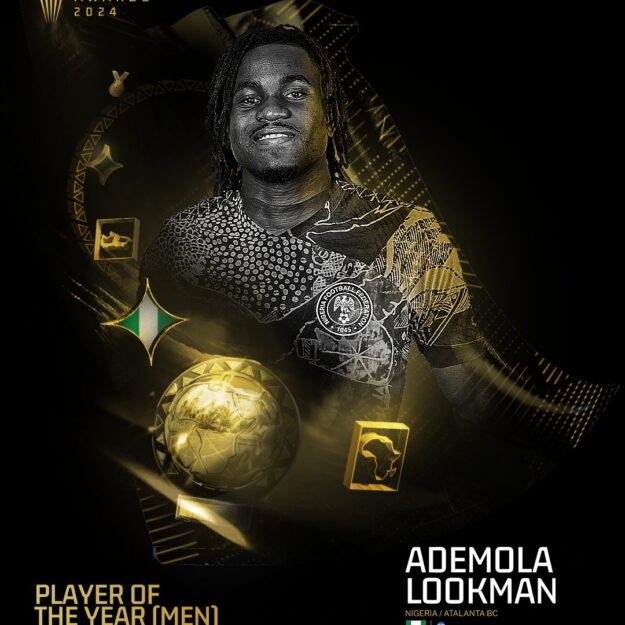

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

Arteta Provides Injury Updates On Five Arsenal Players Ahead Palace Clash

Webby - December 20, 2024Arsenal manager Mikel Arteta has revealed that Declan Rice and Riccardo Calafiori are both available to be in the Gunners…

Carabao Cup: Spurs Edge Man United In Seven-Goal Thriller To Reach Semi-finals

Webby - December 19, 2024Tottenham Hotspur edged Manchester United 4-3 in the quarter-finals of the Carabao Cup on Thursday.Spurs raced to a 3-0 lead…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)