The March 26 decision by the monetary authorities, to slash the Monetary Policy Rate (MPR), from 14 per cent to 13.5 per cent, though long overdue, could not have come at a better time, considering the steady progress recorded since the economy exited the recession in the second quarter of 2017. The Monetary Policy Committee (MPC) had, vide its communique, stated that ”the committee was convinced that doing this will further uphold the banks’ commitment to promoting strong growth by way of encouraging credit flow to the productive sectors of the economy”.

Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, was even more succinct when, in the course of his parley with the media shortly after, observed: “Having been on this path, particularly the MPR at about 14 per cent since July 2016, and with the relative stability we have seen in the macro-economic variables over the last two to two-and-a-half years, we just think that this should be the next phase, where we begin to think about consolidating growth. This should be the next phase where you should be talking about how do we create more jobs and reduce the level of unemployment in our country for people”.

He noted that the decision merely followed the path already charted by the banks, majority of which have started dropping the interest rate marginally. Said Emefiele: “I will say that we are following them (the banks). That is why we say that we are signalling. We are signalling in the sense that with time this will permeate the entire banking sector and people will begin to see the expected impact.”

The issue of high MPR, as indeed of high-interest rates as a whole, is certainly an old problem. Signalling or not, we have certainly come a long way from when Kaduna State Governor, Nasir el-Rufai, took the extremist view of not only faulting the decision of the CBN to hike the MPR from 12 per cent to 14 per cent, but went as far as to suggest that the government reduce same through legislation.

Unquestionably, the CBN has done an admirably good job of steadying the economy in the last two years. Presently, headline inflation has climbed down from 18.6% then to 11.3 per cent; so also has the nation’s foreign reserves moved up from $23.69 billion to $45 billion. As against the volatility of yore, exchange rates in all the markets has since converged around N358 – 360/$1 just as the positive GDP growth trajectory has been consistent for about five quarters.

The obverse side of the equation – unfortunately – is that growth has remained not only sub-par but fragile; unemployment and its companion, poverty, have also soared. To this we add the old, but intractable problems of high cost of funds and access to credit by small and medium scale enterprises. This is why the slashing of banks’ reference lending rate, no matter how tokenistic or symbolic it appears at this time, not only finds great merit but is actually a welcome development, as it comes with expectations of reductions in the cost of borrowing at least in the long run.

Yet, there is a sense in which one needs to be cautiously optimistic about what the signal forebodes. To be sure, nothing of the fundamentals has changed. In other words, nothing as far as we can see is guaranteed.

For instance, retaining the asymmetric corridor of +200/-500 around the MPR, the cash reserves ratio (CRR) at 22.5 per cent, and liquidity ratio at 30 per cent, still panders, largely, to the traditional obsession with liquidity tightening and inflation targeting. It says nothing about the problem of unbridled public sector spending, which gave rise to these measures in the first place. Would the MPC go back to the default mode of monetary tightening, should things change overnight as they could?

And how about the moral dilemma of routinely visiting the ‘sins’ of unrestrained public sector spending on the private sector – supposedly the drivers of the economy – through punitive cycles of monetary tightening?

Nonetheless, we welcome the cut particularly if it heralds a new dawn of progressively lower interest rates. With the apex pulling all the stops at deepening and diversifying the economy, an approach less yoked to inflation fighting with singular focus on growth and job creation would seem the natural order of things. To us, it is the least course for the apex bank to pursue at this time.

You may be interested

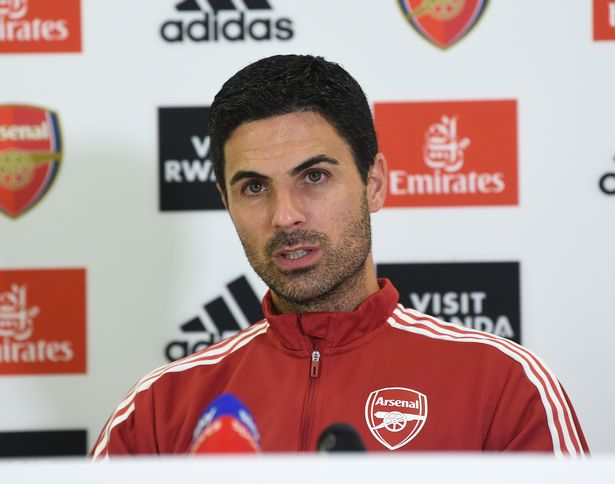

Arsenal Equal Chelsea’s London Derby Feat After 5-1 Win Vs Palace

Webby - December 21, 2024Arsenal equaled Chelsea’s London derby achievement following their 5-1 win against Crystal Palace in Saturday’s Premier League game at Selhurst…

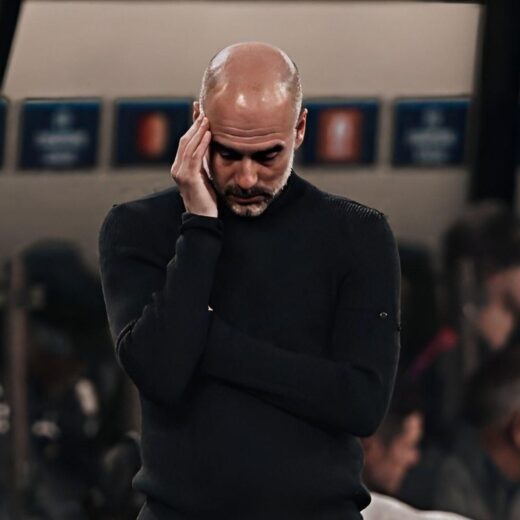

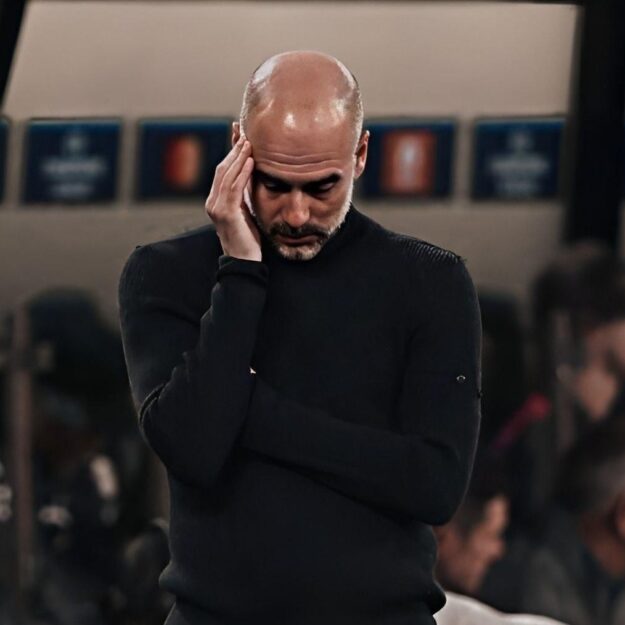

Haaland Backs Guardiola To Turn Man City’s Poor Form Around

Webby - December 21, 2024Erling Haaland had said he and his Manchester City teammates are still backing manager Pep Guardiola to turn the team’s…

PSG To Reignite Interest In Osimhen

Webby - December 21, 2024Paris Saint-Germain have contacted Napoli to discuss signing Victor Osimhen in January, according to reports in France.It is reported that…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)

Leave a Comment