Confusion has arisen among many Nigerians, as the Federal Inland Revenue Service (FIRS), as part of measures to reduce disputes in real estate related transactions and generate more revenue, has announced that stamp duty will be paid on house rent and Certificate of Occupancy (C of O), in line with its new adhesive duty.

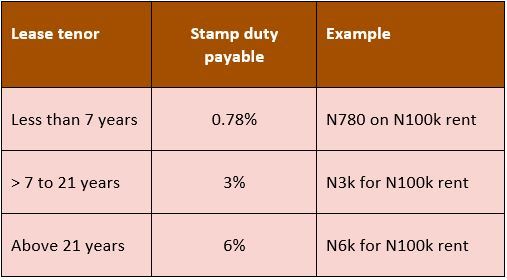

However, it is informative for concerned Nigerians to note that Stamp duty on most rent agreements is at the rate of 0.78%, not 6% as being widely circulated. Based on the Stamp Duties Act, stamp duty on lease or rent agreement is payable as follows:

If the lease term is less than 7 years, stamp duty rate is 0.78% (e.g. N780 on N100k rent)

For a term of 7+ to 21 years, stamp duty rate is 3% (N3k for N100k rent)

For a term above 21 years, stamp duty rate is 6% (e.g. N6k for N100k rent)

Given that most people enter into rent agreements for less than 7 years, the applicable stamp duty rate to most people will be 0.78%.

If you are an individual renting from another individual, your stamp duty is payable to the state tax authority such as LIRS if you are resident in Lagos. If either the tenant or the landlord is a company, then the duty is payable to FIRS.

The obligation to pay stamp duty on rent rests with the tenant. However, FIRS is seeking to appoint the landlord as the agent to collect and remit the tax.

Here is the summary of stamp duty payable on rent:

The Federal Inland Revenue Service (FIRS), as part of measures to reduce disputes in real estate related transactions and generate more revenue, recently announced that stamp duty will be paid on house rent and Certificate of Occupancy (C of O), in line with its new adhesive duty.

Thr FIRS Director for Communication and Liaison Department, Mr Abdullahi Ahmad, said this in a statement in Abuja, on Thursday July 2.

Ahmad said the new policy was necessary so as to give the instruments the legal backing required, and make them legally binding on all parties involved in such transactions.

Ahmad further urged Nigerians to ensure that documents that relate to rent and lease agreements for homes or offices, C of O, and other common business-related transaction instruments were authenticated with the new FIRS Adhesive Stamp Duty.

While quoting the Executive Chairman of FIRS, Ahmed said, “The following are the chargeable transactions in the Fixed Duty Instruments category, Power of Attorney (PoA), Certificate of Occupancy (C of O), Proxy form; Appointment of Receiver, Memorandum of Understanding (MoU), Joint Venture Agreements (JVA), Guarantor’s form, and Ordinary Agreements Receipts.

“While ad-Valorem Instruments chargeable under the Stamp Duties Act are Deed of Assignment, Sales Agreement, Legal Mortgage or Debentures, Tenancy or Lease Agreement, Insurance Policies, Contract Agreements, Vending Agreement, Promissory Notes, Charter-Party and Contract Notes.

“Stamp duty is basically charged in two forms, either ad valorem where duty payable is a percentage of the consideration on an instrument or a fixed sum irrespective of the consideration on dutiable instrument or document.’’

You may be interested

Boniface Scores As Leverkusen Beat Bochum, Close In On Bayern Munich

Webby - March 28, 2025Victor Boniface was on target for Bayer Leverkusen in their 3-1 home win against Bochum in the Bundesliga on Friday…

NPFL: Defeat To Kwara United Painful — Nasarawa United Boss Yusuf

Webby - March 27, 2025Nasarawa United head coach Salisu Yusuf has reacted to his team’s 1-0 loss to Kwara United, reports Completesports.com. Emeka Onyema…

Cote d’Ivoire Withdraw As Host Of U-20 AFCON

Webby - March 27, 2025Cote d’Ivoire announced late Tuesday its withdrawal from hosting the 2025 U-20 Africa Cup of Nations just weeks before the…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)