The Central Bank of Nigeria (CBN) has said that Currency Processing Companies (CPCs) must have a minimum capital of N3 billion to obtain a licence to operate nationwide.

The apex bank added that CPCs with a national licence will be designated National CPC and thus registered to operate in all states of the federation

The apex bank disclosed this in its revised guidelines for the registration of Cash-In-Transit and Currency Processing companies in Nigeria.

The guidelines stated: “A company registered to operate as a National CPC shall: Have a minimum capital of N3 billion or such other amount as may be prescribed by the CBN from time to time; Be entitled to establish offices in any State of the Federation subject to approval by the CBN, for the purpose of carrying out its operations”.

The CBN also stipulated minimum capital base of N2 billion for Regional CPC, wit license to operate within the states of one geo-political zone.

The guidelines stated: “A company registered to operate as a Regional CPC shall: Have a minimum capital of N2 billion or such other amount as may be prescribed by the CBN from time to time; Be entitled to establish offices in states within one (1) geopolitical zone subject to approval by the CBN, for the purpose of carrying out its operations; Be authorized to process cash in naira and foreign currencies within one (1) geo-political zone.”

You may be interested

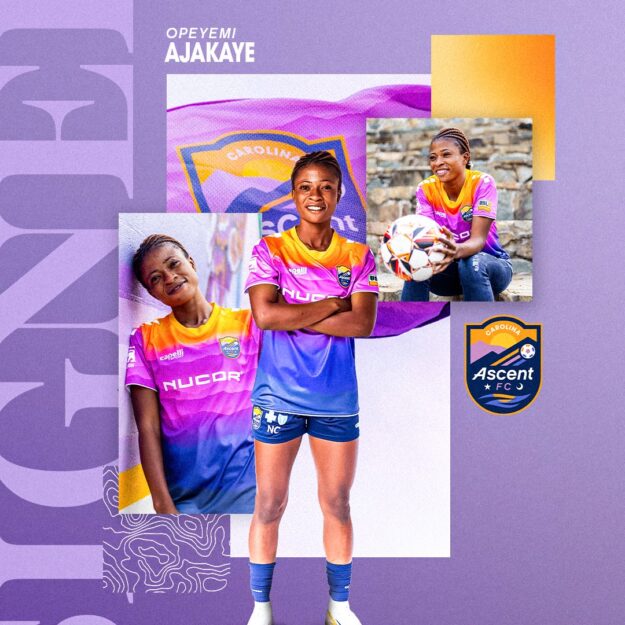

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

Ghana Miss Out On AFCON 2025 Qualification After Draw With Angola

Webby - November 15, 2024Black Stars of Ghana’s hopes of qualifying for next year’s AFCON was ended after they played a 1-1 draw away…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)