The Central Bank of Nigeria (CBN) has released new guidelines for contactless payments in the country, limiting the daily cumulative transaction limit via the channel to N50,000 and single transactions limit to N15,000.

This was contained in a circular signed by the CBN director Payments and Systems management Department, Musa Jimoh, to all banks, financial institutions and payment service providers issued yesterday.

According to the circular, higher value contactless payments which exceed the limits “shall require appropriate verification authorisation. For these transactions, existing KYC requirements and limits on the electronic payment channels shall apply. Limits above this stipulated daily cumulative limit shall be conducted using contact-based technology.”

The guideline stated that “banks shall determine appropriate transaction and daily cumulative limits for contactless payments from time to time. Stakeholders shall be permitted to set limits in line with the bank’s limits.

“Contactless payment transactions below stipulated limits per transaction/day, may not require customers’ authorisation (such as Personal Identification Number [PIN], token, biometrics, etc.). Higher-value contactless payments shall require customer verification such as PIN, mobile code, biometric identifier, etc.

“Stakeholders shall implement a risk-based approach to setting volume and transaction limits. The risks attached to a customer will be based on KYC due diligence carried out during the customer onboarding process.

“Stakeholders shall provide customers with a choice to specify limits for the value of transactions that they would perform and such limits shall not be higher than the maximum limits specified from time to time. Customers who wish to perform transactions above the maximum limit should request in writing to the bank and provide indemnity that reflects the risks involved. The bank shall approve, subject to its internal risk management policies.”

The apex bank noted that it had released the guidelines in furtherance of its mandate to ensure the safety and stability of the Nigerian Financial System, promote a resilient and stable payments system, the CBN, pursuant to the provisions of Section 2(d) of the CBN Act 2007, and its power to make regulations for banks and other financial institutions entrenched in Section 56(2) of the Banks and Other Financial Institutions Act (BOFIA) 2020, hereby issues this Guidelines for Contactless Payments in Nigeria.

Contactless technology enables an alternative payment method whereby payment instruments are used without physical contact with devices. Contactless technology in payments provides easy, convenient, and efficient cashless options for users.

Examples of contactless payment instruments include prepaid, debit and credit cards, stickers, fobs, wearable devices, tokens and mobile electronic devices. Contactless-enabled payment terminals interact with contactless payment devices to facilitate payments.

You may be interested

NPFL: Finidi Satisfied With Rivers United’s Draw Vs Remo Stars

Webby - November 18, 2024Rivers United head coach, Finidi George has expressed satisfaction with his team’s performance in Sunday’s Nigeria Premier Football League (NPFL)…

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

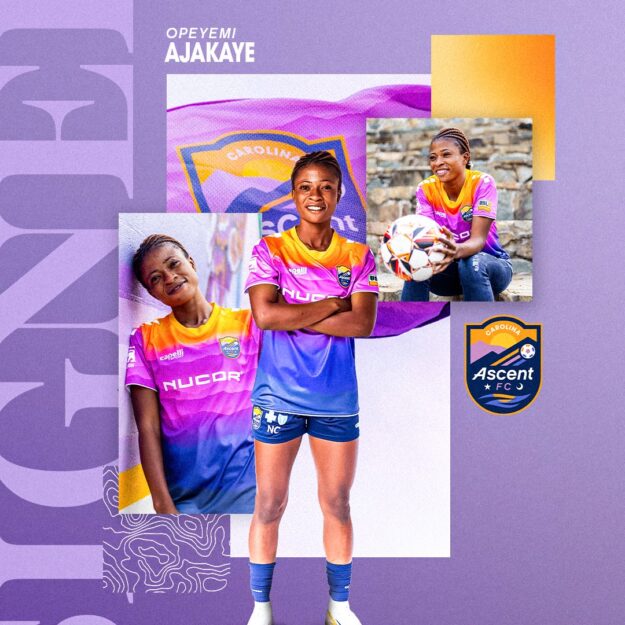

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)