The Federal Inland Revenue Service (FIRS) on Monday arraigned Fortless Global Concept Limited and Everyday Wine Shop alongside their representatives at the Federal High Court, Abuja for alleged tax evasion, obstruction and attack on revenue collection staff on duty.

In the charge, No: FHC/ABJ/CR/48/2019, Fortless Global Concept Limited, which operates the Fortless Supermarket and Stores, was charged along with Chukwu Ejike on six counts bordering on tax evasion and assault on FIRS staff on duty.

The court said the charge was pursuant to Section 174 (1) of the Constitution of the Federal Republic of Nigeria 1999 (As Amended) and Section 47 of the FIRS Establishment Act No: 13, 2007.

Similarly, in the charge No: FHC/ABJ/CR/47/2019 was preferred against Everyday Wine Shop and Bar, along with Mbah Sunday and Epkeha Peter, for committing a similar offence.

Messrs Sunday and Peter Ejike were granted administrative bail after they pleaded not guilty to the charges.

Justice Taiwo O. Taiwo of the Federal High Court 10, Abuja granted the application of the leader of FIRS prosecution counsel, James Binang, and scheduled March 21 for hearing.

Following undertaking by the counsels of the defendants (Sanya Amos for Everyday Wine Shop) and M. A Ejeh for Fortless Global Concept Limited) the court also asked the counsel to bring the defendants to court on the adjourned date.

Mr Binang said FIRS was prosecuting the defendants to serve as a deterrent for others who would want to evade taxes or prevent tax officers from carrying out their responsibilities.

“We cannot allow this to continue. Our staff were assaulted and their dresses were torn. The FIRS wants to prosecute these cases to their logical conclusions to send signals to other people who would want to commit similar offences,” Binang told the court.”

Everyday Wine Shop and Bar and its representatives, Mbah Sunday and Epkeha Peter, were accused of conspiring to commit the offence on or about the January 24 at the Federal Housing Estate, Lugbe, Abuja.

They were accused of failing in their obligation to deduct and remit Value Added Tax (VAT) due to the Federal Government in the course of their business, as well as participating in tax evasion, an an offence punishable under Section 49(1) and (2) of the Federal Inland Revenue Service (Establishment) Act, No. 13 of 2007.

The accused persons were also accused of conspiring to obstruct and assault Funke Shodunke, an authorised official of the FIRS from performing her lawful official functions.

A statement from the FIRS sent to the media alleged that the accused conspired to stop Ms Shodunke from pasting the VAT non-compliance notice on their business premises among those of persons and individuals adjudged by the Service to be non-tax compliant.

You may be interested

NPFL: Finidi Satisfied With Rivers United’s Draw Vs Remo Stars

Webby - November 18, 2024Rivers United head coach, Finidi George has expressed satisfaction with his team’s performance in Sunday’s Nigeria Premier Football League (NPFL)…

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

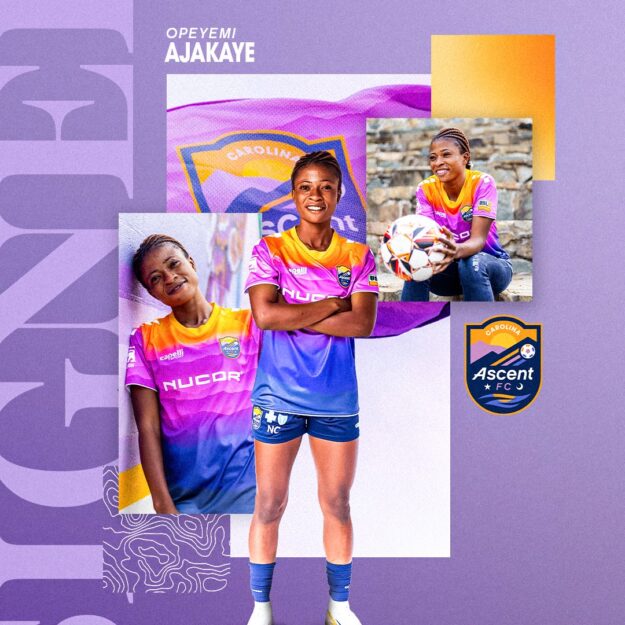

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)