In an effort to stabilize the nation’s volatile exchange rate, the Central Bank of Nigeria (CBN) has directed Deposit Money Banks to sell their excess dollar stock by February 1, 2024, as revealed in a circular released on Wednesday.

The CBN cautioned against hoarding foreign currencies for profit and expressed concerns over certain banks holding substantial long-term foreign exchange positions to capitalize on exchange rate volatility.

The circular, titled “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks,” introduces guidelines aimed at mitigating risks associated with such practices. This directive comes shortly after a previous circular warning banks and FX dealers against reporting false exchange rates.

The move also follows the adjustment of the methodology used to calculate the nation’s official exchange rate by the FMDQ Exchange, resulting in the Nigerian Autonomous Foreign Exchange Market rate rising from approximately N900/dollar to N1,480/dollar.

Economists and stakeholders have praised this adjustment for unifying official and parallel market exchange rates.

In response to the alleged excess foreign exchange positions held by banks, the CBN’s latest circular, dated January 31, 2024, signed by Dr. Hassan Mahmud and Mrs. Rita Sike, outlined prudential requirements. It focused on managing the Net Open Position (NOP), which measures the difference between a bank’s foreign currency assets and liabilities.

The circular stipulates that the NOP should not exceed 20 per cent short or 0 per cent long of the bank’s shareholders’ funds, with calculations based on the Gross Aggregate Method. Banks exceeding these limits must adjust their positions by February 1, 2024. The CBN directed banks to use specific templates for daily and monthly NOP and Foreign Currency Trading Position (FCT) calculations.

Banks are also required to maintain high-quality liquid foreign assets and adopt adequate treasury and risk management systems for oversight of foreign exchange exposures. Non-compliance with NOP limits may result in immediate sanctions and suspension from the foreign exchange market.

An anonymous top bank executive suggested that the new circular would compel banks to sell excess dollar liquidity exceeding $5 billion.

You may be interested

Van Nistelrooy Applies For Vacant Coventry Coaching Job

Webby - November 16, 2024According to talkSPORT, (Yahoo! Sport) Van Nistelrooy has already applied for the vacant manager role at Championship side Coventry City.This…

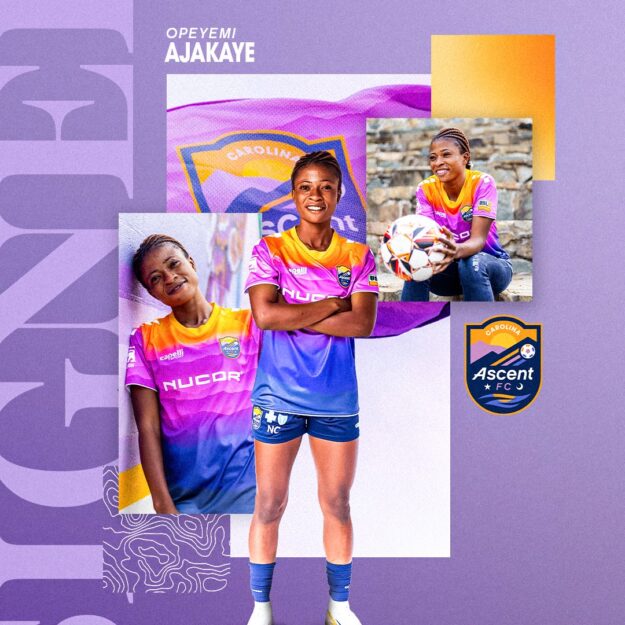

Done Deal: Falconets Forward Joins American Club Carolina Ascent

Webby - November 16, 2024Former Falconets forward Opeyemi Ajakaye has joined USL Super League club, Carolina Ascent FC on loan.Ajakaye linked up with Carolina…

Orban’s Lyon Face Provisional Relegation To Ligue 2 Amid Financial Woes

Webby - November 15, 2024Olympique Lyon the club of Nigerian striker Gift Orban, have been handed a provisional Ligue 1 relegation by theDNCG who…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)