NIGERIA is not in any way near a debt crisis despite its N24.39 trillion (about $79.44 billion) debts, the Federal Government has said.

The debt figure, which, as at December 31, 2018, comprised Eurobond loans, facilities from the World Bank Group, China and Africa Development Bank Group constitute over 80 per cent of the total debt stock.

It represents a year-on-year growth of 12.25 per cent and is higher than the 2017 figure by N2.662 billion.

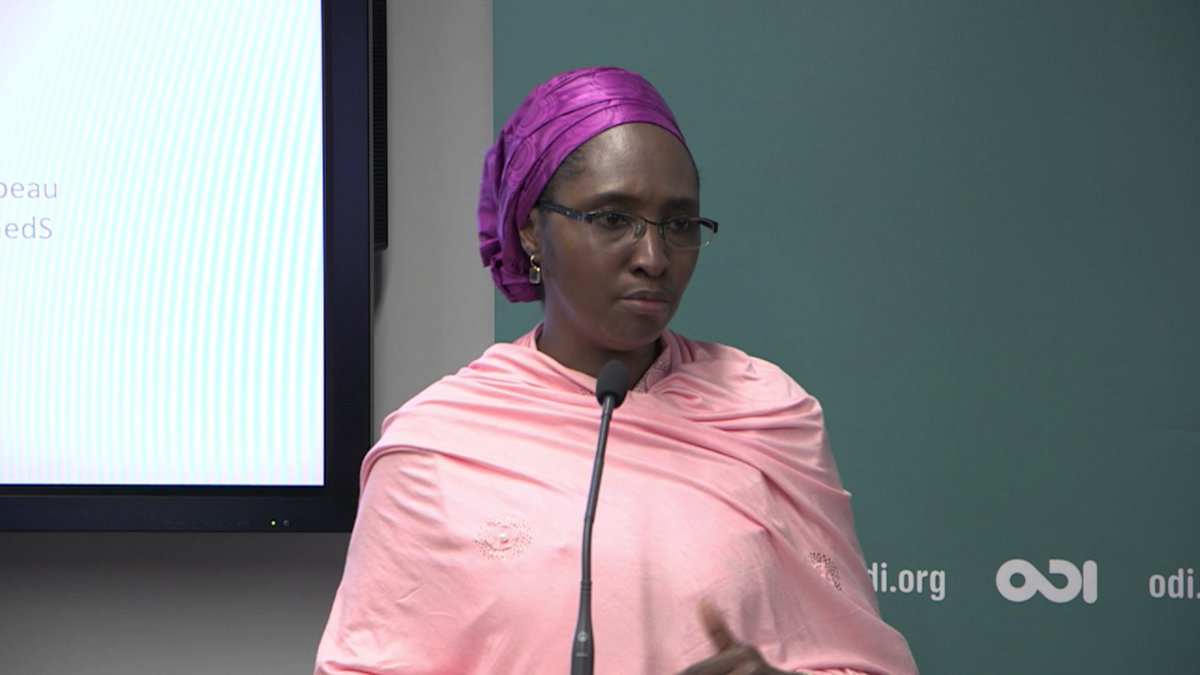

Finance Minister Mrs. Zainab Ahmed, who made the disclosure at the sidelines of the just-concluded International Monetary Fund/World Bank Spring Meetings in Washington D.C, explained that despite warnings by the multilateral institutions, the country was not in any way near a debt crisis.

Her position was collaborated by FSDH Research latest report on Nigeria’s debt position titled: Is Nigeria public debt too high? Analysts at the Lagos-based investment company argued that since Nigeria’s public debt-to-Gross Domestic Product (GDP) ratio was still under 20 per cent, precisely 18.89 per cent, it can still get more loans to reach the 25 per cent benchmark set for itself and the 56 per cent international threshold set for countries in Nigeria’s peer group.

REad also: No agreement with IMF on removal of fuel subsidy – Minister

The analysts at FSDH Research said Nigeria still has room to borrow an additional N7.89 trillion before reaching a threshold of about N32 trillion.

FSDH Research data showed that countries like China, South Africa, India, UK, Brazil and the United States (U.S.) all have high debt-to-Gross Domestic Product (GDP) of 50 per cent, 57 per cent, 70 per cent, 87 per cent, 88 per cent, 91 per cent and 106 per cent respectively.

It, however, stressed that these countries have successfully managed to deploy their borrowings into activities that can stimulate revenue generation including education, transportation, construction, security, technology and other growth-enhancing infrastructure.

The FSHD report explained that by utilising the borrowed funds in areas that improve the ease of doing business in their countries, they have been able to grow their economies further, create job opportunities, and create more avenues for their governments to grow their revenue.

It said: “The 25 per cent benchmark gives Nigeria a leeway to borrow an additional N7.89 trillion given her level of GDP. But before you are quick to celebrate, there is the need to consider one very important factor: the ability of the country to service the debt without causing untold hardship on the country.

“In measuring the ability of a country to service her debt obligations, we look at the ratio of domestic debt service-to-Federal Government of Nigeria Federation Accounts Allocation Committee (FAAC) allocation.”

The IMF had during the Spring Meetings warned Nigeria and other emerging market countries taking excessive loans from China to consider the terms of such facilities, especially, their compliance to the Paris Club arrangements.

Director, IMF Monetary and Capital Markets Department, Tobias Andrian, said there was nothing bad in borrowing from China, except that the terms of such loans are always questionable.

He said: ‘Loans from China are good, but the countries should consider the terms of the loans. And we urge countries that when they borrow from abroad, that the terms are favorable for the borrower, and should be conforming to the Paris Club arrangements”.

Continuing, Andrian, who spoke on the Global Financial Stability Report (GFSR) said: “Let me reiterate that in many frontier markets, we see that the share of debt that is not conforming to the Paris Club standards is on the rise. And that means that if there is any debt restructuring down the road one day that can be very unfavorable to those countries. So, the borrowing terms, the covenants, are extremely important. And we do see a deterioration in that aspect.”

But Mrs. Ahmed explained that while government borrows to deliver on its promises, it is also mindful of rising debt burden, which eats up about 25 per cent of the country’s annual earnings.

The minister said: “The World Bank and IMF are cautioning us on the rate at which we are borrowing. They are also cautioning us on the need to build fiscal buffers because the global economy is going to be facing some risks and we agree with that.

“We are very mindful of the level of our borrowings. Our borrowing is very much within fiscal limits right now. What we are doing is to increase our revenue generating capacity to make it easier for us to meet our debt obligations, routine and capital expenditure.”

Responding to concerns on Chinese loans to finance the Idu-Kaduna, Lagos-Ibadan and Abuja light rail projects, expansion of four airport terminals and some hydroelectric projects across the country, the minister said: “To borrow, we go through several processes of assessments as well as negotiations. We make sure we get the best possible terms and whether we are borrowing from financial institutions or in Europe or China or anywhere else, we try to get the best rates of borrowing. So far, the conditions we have got are very good ones.”

Mrs. Ahmed said the government of President Muhammadu Buhari is committed to ensuring that the country grows in a manner that would bring many people out of poverty.

According to her, it is for this reason that the government takes its social investment programmes like the school feeding, Conditional Cash Transfers to the poor and vulnerable and TraderMoni programme, very seriously.

You may be interested

UCL: Atletico Madrid Will Come Out Stronger Against Borussia Dortmund –Simeone

Webby - April 16, 2024Atletico Madrid coach Diego Simeone has disclosed that the team has a stronger game plan to overcome Borussia Dortmund in…

7 Players Who Merit Super Eagles Call-up For Next 2026 W/Cup Qualifiers

Webby - April 16, 2024The Super Eagles will take on South Africa and Benin Republic in the 2026 FIFA World Cup qualifiers in June.After…

The Hidden Truth That Led To Killing Of 17 Soldiers In Okuama Delta State

Webby - April 16, 2024A feud between an illegal oil bunker, Endurance Okodeh alias Amangbein and a sophisticated cartel of powerful illegal oil bunkers…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)